A look at a few of the mining headlines that caught my eye this morning with some additional comments on each.

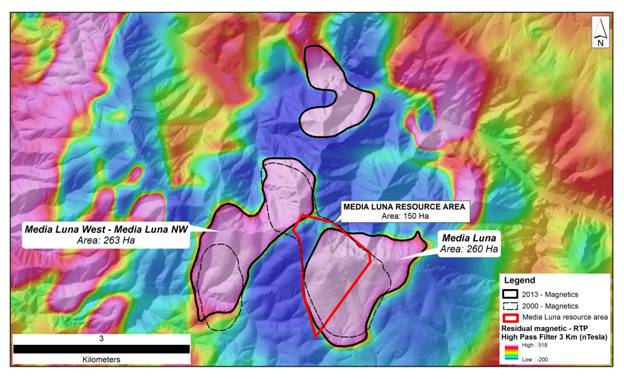

Torex Gold - (TXG:TSX) - Torex is out this morning with a new PEA on the Media Luna project in southwest Mexico. Also included in the news release was an updated 43-101 resource estimate showing 7.42 million gold equivalent ounces (an increase of 1.6 million geo's).

The PEA on Media Luna shows an after tax IRR of 24.6% at $1200 gold, $3 copper, and $20 silver. Investors take note those metal prices are significantly higher than current prices.

Also the PEA is based on inferred resources which will need to be upgraded to mineral reserves.

The total CAPEX is reasonable at $481.4 million and will be spread out over 4 years.

Fred Stanford, President and CEO of Torex stated: "Our strategy has always been to get the El Limon-Guajes ("ELG") resource up to 5 million ounces and build the mine, find a second mine on the same property and build that one as well. Progress toward completion of the construction of the ELG Mine continues to be excellent, and this PEA for the Media Luna resource illustrates the potential viability of those resources on the same property both on a commercial and social basis. The conceptual mine design, as proposed in the PEA, is innovative and elegant in the way that it turns technical and social challenges into commercial advantages. The design minimizes the amount of land required, provides the potential for long term employment opportunities for neighbouring communities, and utilizes the recently built ELG infrastructure to minimize security exposures and to control costs. The fact that this PEA is based on exploiting only 31% of the targeted magnetic anomalies is a testament to the potential of the Media Luna anomalies to support an expansion of the existing mineral resources."

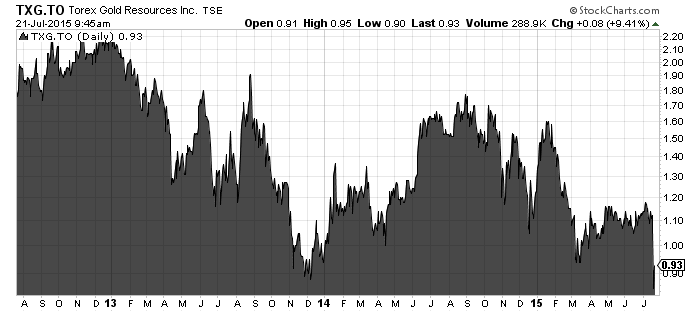

The three year chart of Torex shows the stock testing lows currently around the December 2014 and March 2015 levels. If you are a gold bull both times Torex had a significant rally off these levels.

Torex is more than 75% complete construction on it's first mine with commercial production expected in May 2016. An updated mine plan was released this morning with first gold pour expected before the end of 2015.

Once in commercial production I would expect a re rating of TXG stock.

Dundee is out with an updated research report on Torex this morning with a $1.80 price target.

Related: Daniel Earle: “Risk Level a Concern As Torex Gold (TXG.TO) Progresses”

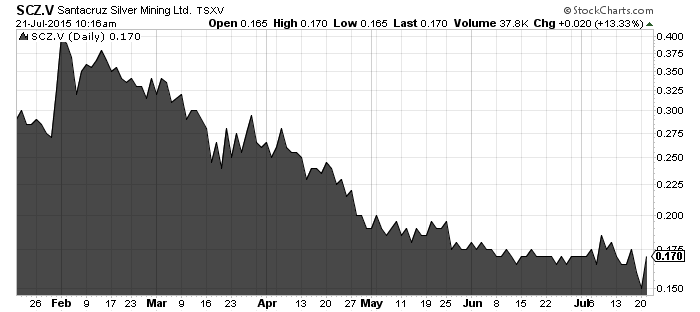

Santacruz Silver - (SCZ:TSXV) - Santacruz Silver has released second quarter production results from the Rosario mine in Mexico. SCZ stock has had all kinds of issues and was a high as $2.70 in 2012 and now trades for 17 cents.

The stock caught my attention today as a possible turnaround story.

Investors will want to see if Santacruz can make a profit when financials are released.

I could count on one hand the number of silver producers making money at the current silver price.

"Santacruz has delivered solid production performance at the Rosario mine in Q2," stated Arturo Prestamo, chief executive officer of Santacruz. "Since the resumption of operations we have delivered increases in throughput and better dilution control resulting in improved head grade on a month-over-month basis resulting in 60 per cent more silver-equivalent ounces being produced in June as compared with April. Our operational staff has performed admirably in the face of the challenging markets putting the company solidly on a path of improved efficiency and reduced costs -- both of which are critical in the face of soft commodity prices. In addition we continue to utlilize our minimum price protection program whereby we set a minimum floor price of $17 (U.S.)/ounce silver on our production. The path forward looks stronger as we continue to increase production while keeping costs well under control."

Santacruz stock has been pummelled with lower silver prices and mine issues. The balance sheet at the end of March showed $9.6 million in current assets and $13.9 million in current liabilities.

In a low silver price environment and a stressed balance sheet investors haven't been shy of selling SCZ stock.

Can management turn it around?

Read:Santacruz Silver Reports Second Quarter 2015 Operations Results

This is not investment advice. All facts are to be checked and verified by reader. As always please do your own due diligence.