Red Eagle Mining (TSXV:RD) has been a junior miner on a mission over the past year, raising roughly its market cap in equity and triple that in debt to build the fully permitted and now fully funded Santa Rosa gold mine in Colombia.

To quickly review the company’s to-do-list this past year, Red Eagle published its Feasibility Study for Santa Rosa demonstrating robust economics last September. In March 2015, the company received its final environmental permit to build and operate the mine. Last week, despite a very difficult junior gold mining financing environment, Red Eagle completed a $19 million equity raise (without warrants or broker fees) that will see it fully funded to build Santa Rosa. The company may now begin drawing down the previously announced US $60 million credit facility provided by Orion Mine Finance.

The engineering firm that will construct, develop and commission the Santa Rosa mine, STRACON GyM, part of the Graña y Montero Group, has agreed to purchase a 19.94% stake in Red Eagle for US $7 million. STRATCON has built and operated underground and open pit gold mines in Mexico and Peru before with partners including Hudbay, First Quantum Minerals, Buenaventura, and Rio Alto Mining. Red Eagle CEO Ian Slater says the company chose STRATCON after a one year process. This is STRATCON’s first minority ownership interest in a junior mining company.

Red Eagle today is in a similar spot to Rio Alto Mining a few years back, Slater thinks. Then, Rio Alto had the La Arena project, with a similar potential production profile to Santa Rosa, despite being an open pit operation (Santa Rosa will be an underground mine). Rio Alto found debt finance from Orion, like Red Eagle, and contracted the mine build to STRATCON, before getting the mine up and running profitably. Earlier this year, Rio sold to Tahoe Resources for C $1.35 billion. Slater would no-doubt like to recreate that value creation path for his company.

Liberty Metals and Mining participate pro-rata in the equity financing to retain its 19.99% stake in Red Eagle. Other participants include mining legend Ross Beaty and high-net worth investors. Debt provider Orion Mine Finance holds roughly 16% of the company and warrants to own up to 19.9%.

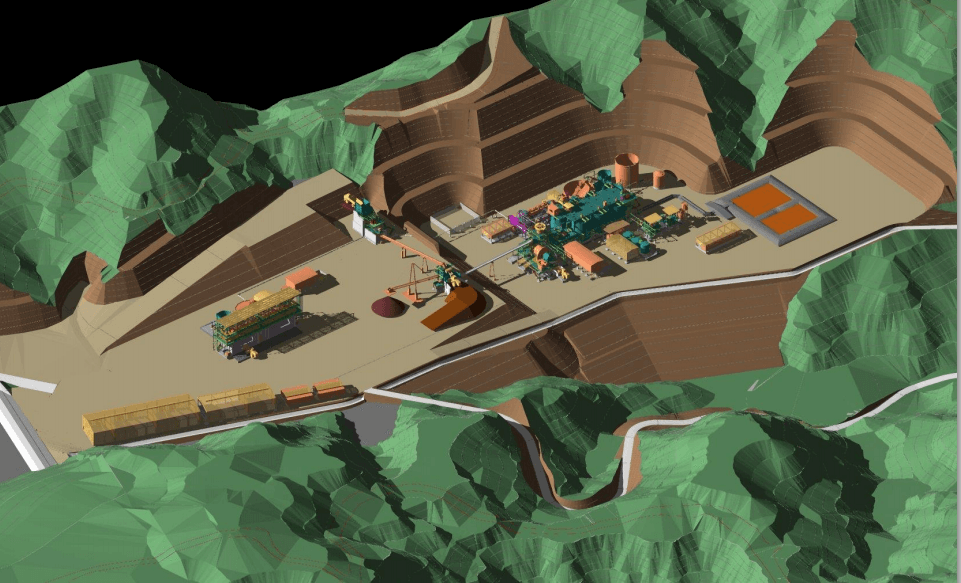

Red Eagle expects to break ground in August 2015 and be in production by H2 2016. Slater says Red Eagle has roughly $80 million US for a $74 million project. The Colombian Peso has declined in value compared to the US Dollar by nearly a third since Red Eagle published its feasibility study, which should give Red Eagle extra breathing room for the cap-ex. Op-ex costs, which are mostly local, should also be reduced as a result of the currency swing.

While Red Eagle has found its construction capital, it will wait for cashflow from operations or a more buoyant exploration finance market before aggressively continuing to explore its Santa Rosa property. The current reserves only go to 250 metres depth and Red Eagle is optimistic the deposit continues below based on exploration drilling previously to 600 metres depth. Targets at depth can be more easily drilled off when the company goes underground during construction. Additionally, Red Eagle has other targets, including additional shear zones, to pursue when the time is right.

During our call, Mr. Slater touched briefly on the proposed offer to acquire CB Gold, another Colombian gold exploration company. Red Eagle and CB Gold were founded at roughly the same time in Vancouver with a focus on Colombia. The companies have similar shareholders, and even moved into the same floor of the same office building during the same month in 2010. Slater believes he has CB Gold shareholder support for the deal, and CB Gold shareholders will decide by August 5, 2015 if they intend to be a part of Red Eagle. Slater would like to build the Santa Rosa mine and then look to develop CB’s Vetas deposit, which has the potential to be a profitable underground mine.

Red Eagle will have roughly 168 million shares outstanding following the $19 million equity raise.

Follow Red Eagle at http://chat.ceo.ca/RD for coverage from our community and insider trade notifications from SEDI in real-time.

DISCLAIMER: The work included in this publication is based on SEDAR filings, current events, interviews, and corporate press releases. It may contain errors, and you shouldn’t make any investment decision based solely on what you read here. This publication contains forward-looking statements, including but not limited to comments regarding predictions and projections. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. The views expressed in this publication and on the CEO.CA website do not necessarily reflect the views of Pacific Website Company Inc., publisher of CEO.CA. Pacific Website Company Inc. has previously provided and multimedia creation and conference exhibition services to Red Eagle Mining which makes CEO.CA biased in its coverage of Red Eagle Mining. This publication is provided for informational and entertainment purposes only and is not a recommendation to buy or sell any security. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies such as Red Eagle Mining can easily lose 100% of their value so read Red Eagle Mining’s profile on www.SEDAR.com for important risk disclosures. It’s your money and your responsibility.