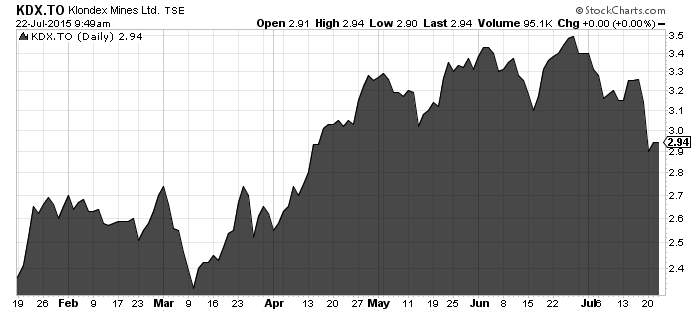

A slow day for mining news as commodity related stocks continue to sell off. Today I take a look at the news from Klondex Mines and Platinum Group Metals.

Klondex Mines - (KDX:TSX) - Klondex Mines has released 2nd quarter production results this morning. The Midas Mine and the Fire Creek project in Nevada combined to sell 34,188 GEO ounces in the quarter. Due to strong operating performance guidance has been increased for 2015 to 125,000-130,000 AUeq ounces.

Klondex is one of the few junior mining companies who gets "it" in my opinion. Instead of focusing on growth at all costs KDX has focused on being profitable and making money for shareholders.

Financial results are expected the week of August 10th. In the first quarter Klondex earned $10.8 million or 8 cents per share.

Paul Andre Huet, Klondex's president and chief executive officer, commented: "These second quarter results from Fire Creek and Midas demonstrate the systematic growth taking place at our operations. The average daily mining rate increased to 722 tons per day in Q2 2015, up from 601 tons per day in Q2 2014, which we attribute to the additional development and mining faces at both operations. In Q2 2015, our gold-equivalent ounces sold increased to 34,188 ounces, up from 25,605 AuEq ounces in Q2 2014."

A very strong start to 2015 for KDX shareholders as management delivers on the operational front. The recent pull-back in KDX stock is due to the weakness in the gold price not operational performance.

In my opinion investors looking to enter or add to the gold space should be looking for junior producers like Klondex who are generating free cash flow. Why would you invest in a senior losing money every quarter?

Haywood has a $4 target out on Klondex for a copy of the report please email your Haywood broker or Jonathon Jones (jjones@haywood.com).

Read: Klondex Reports Record Sales of 34,188 GEOs in 2Q2015; Increases Production Guidance for 2015

Related: 5 gold producers making money at $1170 gold

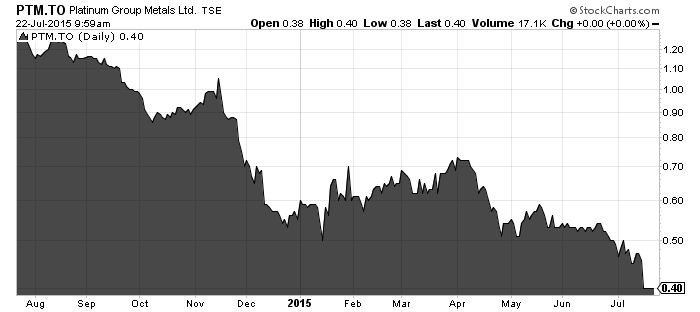

Platinum Group Metals - (PTM:TSX) - Platinum Group Metals is out with an updated mineral resource for the massive Waterberg project in South Africa. The new resource on the 58.62% owned joint venture shows 25.64 million ounces platinum,palladium, and gold inferred plus 12.61 million ounces indicated.

Drilling continues at the project with 10 drill rigs turning and is still open for expansion. All drilling this year is fully financed by JV partner Japan Oil, Gas, and Metals National Corp.

Platinum Group Metals stock has been cut in third in the last year and now trades at $307 million dollar market cap. The main reason has been the decline in platinum from $1500 last July to $967 today.

To put it into perspective construction is 90% complete on the $514 million dollar WBJV Project 1 platinum mine with initial production scheduled in Q4.

Interesting times when you can buy 90% of a constructed mine for much less than the cost of building it. The big question for investors will be if PTM can be profitable at current metal prices?

Related: Vancouver mine builder goes platinum in South Africa

This is not investment advice. All facts are to be checked and verified by reader. As always please do your own due diligence.