A quick look at the news releases from NexGen Energy and Semafo with additional comments on each. Thanks for reading.

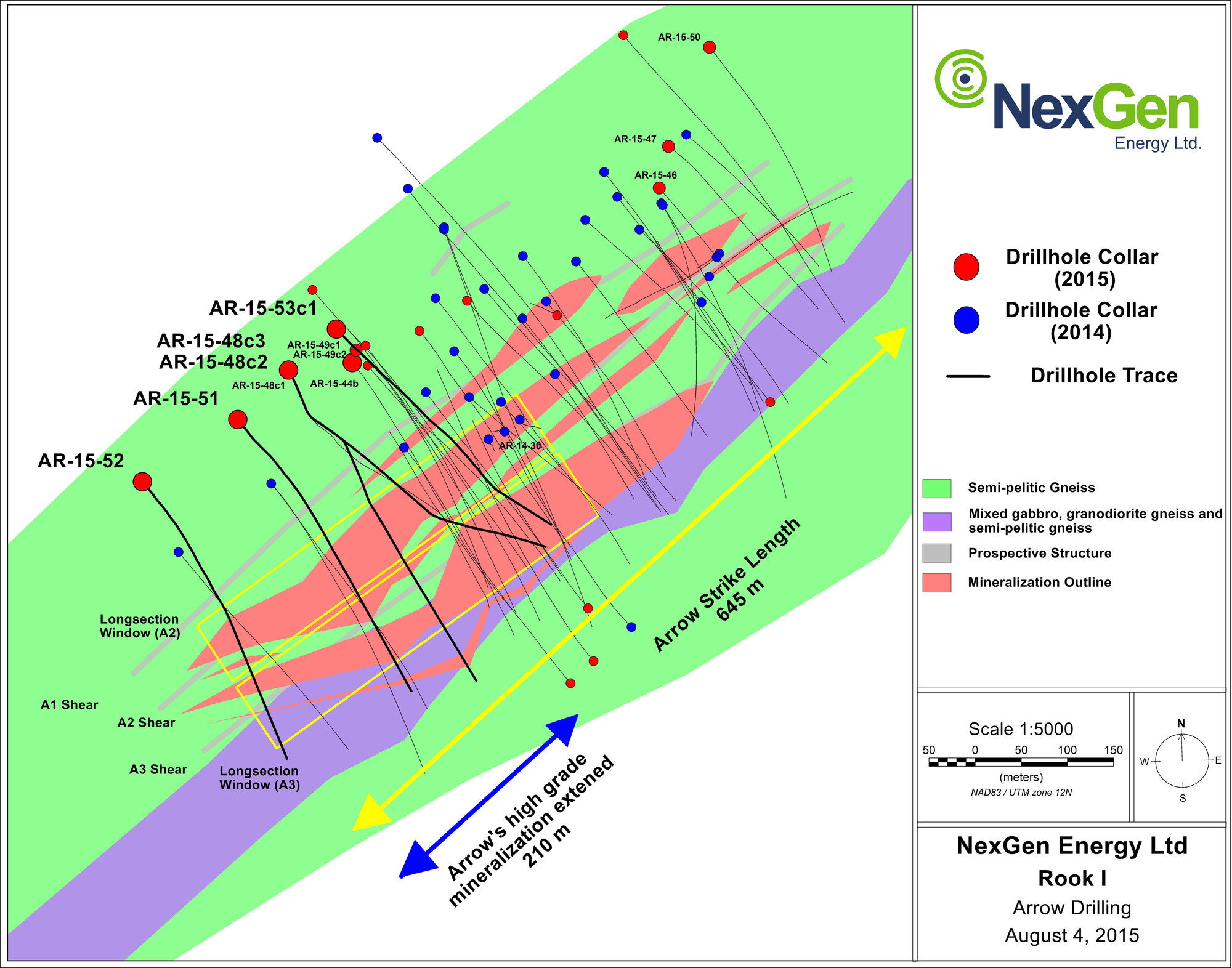

NexGen Energy - (NXE:TSXV) - NexGen is out with radioactivity results for 5 drill holes from the Rook 1 property in Saskatchewan. All 5 drill holes this morning have intersected substantial mineralization and were step out holes. The radioactivity results today have tripled the A2 shear zone and A3 shear zones to to at least 300 m and 295 m, respectively.

Another key item to note is that newly discovered material southwest of Arrow remains open in all directions and at depth.

Highlights:

Arrow - Southwest Extension

- AR-15-48c3 (a 55 m step out to the south west from AR-15-44b) intersected 170.5 m of total composite mineralization including 13.2 m of off-scale radioactivity (>10,000 - >61,000 cps) within a 530.5 m section (483.5 to 1,014 m).

- AR-15-51 (a 100 m step out to the south west from AR-15-44b) intersected 160.25 m of total composite mineralization including 8.0 m of off-scale radioactivity (>10,000 to 47,000 cps) within a 462.5 m section (513.5 to 976.0 m).

- AR-15-52 (a 210 m step out to the south west from AR-15-44b) intersected 60.8 m of total composite mineralization including 4.0 m of off-scale radioactivity (>10,000 to 45,000 cps) within a 394.0 m section (527.5 to 921.5 m). AR-15-48c2 (a 50 m step-out up-dip from AR-15-44b) intersected 114.4 m of total composite mineralization including 3.15 m of off-scale radioactivity (>10,000 to 46,000 cps) within a 488.0 m section (423.0 to 911.0 m).

Arrow - A2 and A3 Core Delineation

- AR-15-53c1 intersected 58.5 m of total composite mineralization including 5.25 m of off-scale radioactivity (>10,000 to >61,000 cps) within a 377.5 m section (520.5 to 898.0 m).

- The Arrow zone now covers an area of 645 m by 215 m with a vertical extent of mineralization commencing from 100 to 920 m, and it remains open in all directions and at depth.

Garrett Ainsworth, NexGen's Vice-President, Exploration and Development, commented "Our bold objective that contemplated 50, 100, and 200 m step outs to the southwest of the A2 and A3 high grade cores have resulted in wide zones of mineralization across both shears with all three of these step outs encountering off-scale radioactivity. We are very pleased to be witnessing such strong continuity of mineralization, and consistent growth with these aggressive southwest step outs."

Leigh Curyer, Chief Executive Officer commented, "The team is obviously excited as to the implications that this latest batch of results has on the size and future growth of the Arrow zone. These holes have tripled the length of the A2 and A3 high grade cores. The drilling methodology of wide step outs continues to intersect significant mineralization. The footprint demonstrates Arrow is a large continuous system of mineralization in both the A2 and A3 shears and is open in all directions. We have a significant amount of additional drilling to perform before we even begin to understand the full scale of Arrow."

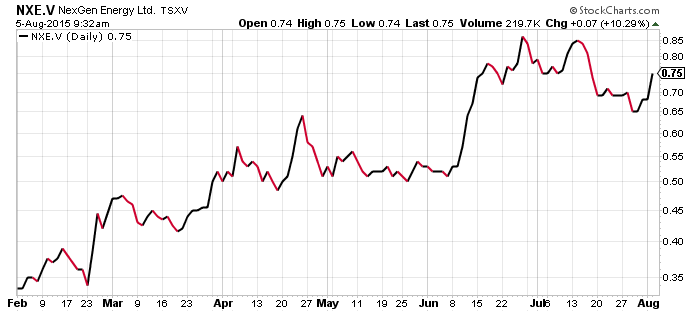

NexGen continues to be one of the bright spots on the TSX Venture when it comes to resource stocks. All signs have indicated the NXE is on to a significant uranium discovery that is only getting larger with additional drilling.

With the recent merger announcement of Fission and Denison leaves very few top quality uranium exploration names. Note this deal has yet to close officially and could still see a competing bid (Cameco?).

NexGen would be at the top of my list when looking at uranium exploration companies. Expect steady news flow as 5 drill rigs are currently turning as part of the summer exploration program.

$NXE is a popular stock in CEO chat and you can find all comments in the company room at http://chat.ceo.ca/nxe

Related:NexGen Energy (NXE:V) the leading uranium exploration stock

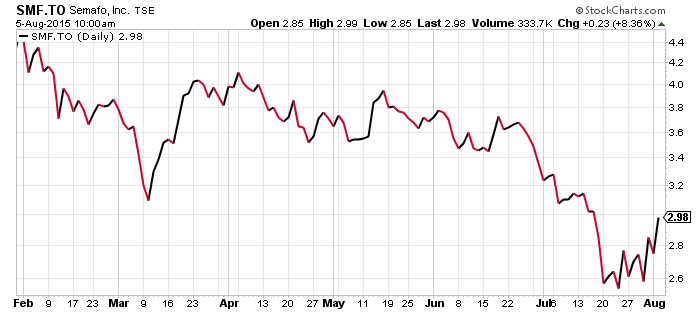

Semafo - (SMF:TSX) - Semafo is out with some excellent second quarter results earning $22.1 million US in net income. This is one of the best second quarters I have seen released so far by a gold company. Semafo was helped by lower fuel prices and a favourable exchange rate.

The Mana Mine delivered 66,000 ounces in the quarter at an all in sustaining cash cost of $604 per ounce. Most mines have a cash cost per ounce much higher than this.

Semafo continues to work on a feasibility study for the high grade Natougou project which is now over 40% complete and on track for completion in Q2 2016. Semafo acquired Natougou when they purchased Orbis Gold earlier this year.

A tough year so far for $SMF holders with the drop in the gold price. Operational performance from my quick look this morning appears to be solid.

Mining investors are well aware of the election upcoming in Burkina Faso (October 2015) and that may be weighing on the share price.

In my opinion these small producers that are generating free cash flow are in a sweet spot and should be a focus point of investors.

Read: SEMAFO's Net Income Increases to $22.1 Million in Second Quarter 2015

Related: Semafo makes an aggressive takeover bid for a high grade gold project

Thanks for reading.

This is not investment advice. All facts are to be checked and verified by reader. As always please do your own due diligence.