A look at my top news releases out this morning in the mining world. Today we look at news releases from Royal Gold and Randgold.

Thanks for reading.

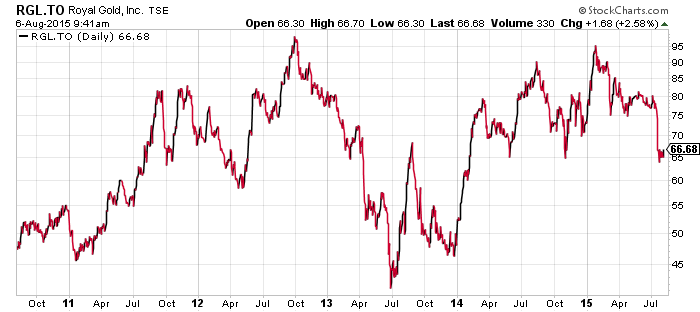

Royal Gold - (RGL:TSX) - Royal Gold has been busy issuing a few news releases in the last couple days. 2015 fiscal results were released this morning and RGL earned $52 million in net earnings ($0.08) per share. Even with gold down 6% year over year operating cash flow was $192.1 million compared to $147.2 million in 2014.

Operating cash flow has been helped by the ramp of the Mt. Milligan mine in British Columbia operated by Thompson Creek Metals.

Fiscal 2015 Financial Highlights:

- Revenue of $278 million, an increase of 17% over fiscal 2014

- Record operating cash flow of $192.1 million, an increase of 31% over fiscal 2014

- Record volume of 227,100 Gold Equivalent Ounces (“GEO’s”) 1

- Adjusted EBITDA2 of $3.33 per basic share, or 78% of revenue

- Cash dividends of $56.1 million, 14 consecutive years of increasing dividends

Tony Jensen, President and CEO, commented, “It is gratifying to report record operating cash flow and record volume today as our portfolio continues to deliver growth, despite a contraction in the gold price. We feel this is an excellent time in the commodities cycle to be reinvesting in our business and we’ve been opportunistic, adding several new pieces of business over the last few months, including transactions with Barrick, Golden Star Resources, Teck Resources, and New Gold, that will build on this platform of growth.”

Precious metal royalty companies (Franco Nevada, Silver Wheaton, and Royal Gold) were common picks among speakers at the Sprott-Stansberry conference in Vancouver last week.

The business model of these companies is rock solid and they generate strong free cash flow even at lower metal prices.

Two of the keynote presentations involved royalty companies featuring David Harquail from Franco Nevada and Randy Smallwood from Silver Wheaton.

Other news from Royal Gold yesterday includes the announcement of acquiring a $610 million dollar gold and silver stream on the Pueblo Viejo mine 60% owned by Barrick. This is a great long term deal for Royal for a couple reasons in my opinion.

1. The mine is already built which provided immediate cash flow.

2. Pueblo Viejo is a world class asset being the only mine in the world with 1 million ounces a year of production with all in sustaining cash costs sub $700 per ounce. Royal I believe was fortunate to take advantage of a stressed balance sheet at Barrick.

Also of note Jamie Sokalsky (ex CEO of Barrick) was appointed to the board of Royal yesterday.

Read: Royal Gold Reports Record Operating Cash Flow for Fiscal 2015

Randgold - (GOLD:Nasdaq) - A record quarter for Randgold in terms of profit and production. Randgold produced over 300,000 ounces in the quarter earning a profit of $59.2 million. The balance sheet is one of the best in he industry with $109 million in cash and no debt.

Key Performance Indicators

- Record group quarterly gold production

- Cash cost per ounce down quarter on quarter and on corresponding 2014 quarter

- Profit up 15% quarter on quarter but down on corresponding 2014 quarter on the back of lower gold price

- Balance sheet remains strong with no debt after dividend and capital investments

- Loulo-Gounkoto improves operational performance across the board

- Kibali continues its strong performance and increases loan repayment

- Morila delivers on plan and prepares for transition to TSF processing

- Improved recovery at Tongon despite power interruptions

- Exploration yields positive results at 9 projects across 4 countries

- Massawa evaluation points to higher grades and Sofia deposit increases optionality

"In the 20 years of Randgold's existence, we have made no material changes to our core strategy, but the refinements we introduced when we saw the downturn coming, and the fact that our business models were prudently based on $1 000 per ounce, are enabling us actively to manage the weakening gold price. At the halfway mark we remain on course to achieve our market guidance for 2015," Bristow said. "We are also very mindful that the increasing stress in the market may create interesting long term opportunities, and we are watching carefully for these."

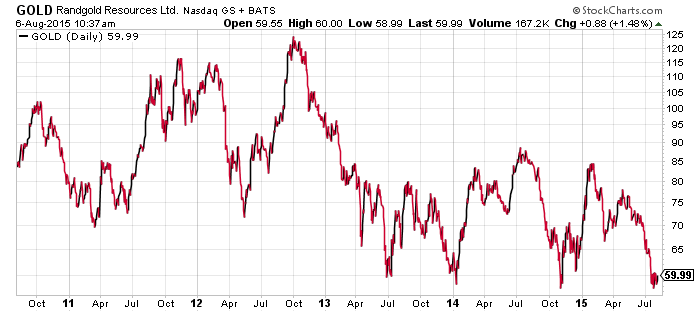

A 5 year chart of Randgold shows plenty of volatility and maybe a quadruple bottom? I am not a chartist but if Randgold can hold these levels it has had a significant bounce the previous 3 times it has.

Randgold has only 93 million shares outstanding and a market cap of $5.6 billion.

Read: Profit and production up, cost down in another record quarter for Randgold

Related: Gold industry in real distress, says Bristow

This is not investment advice. All facts are to be checked and verified by reader. As always please do your own due diligence.