A look at a few mining headlines out this morning that caught my eye with some additional comments on each.

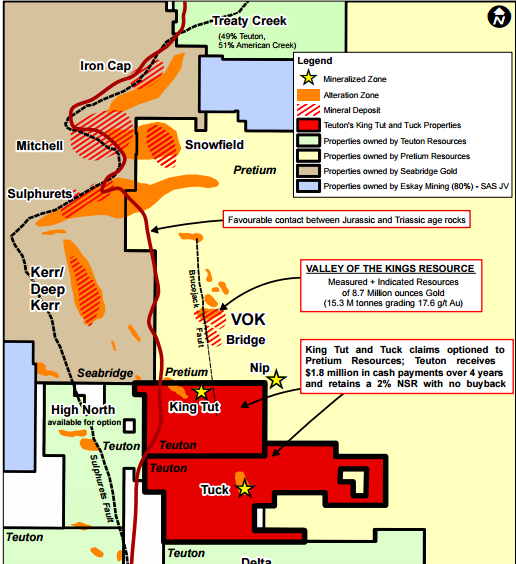

Pretium Resources (PVG:TSX) and Teuton Resources (TUO:TSXV) - The old saying in real estate is location,location, location! The same can be said in mining that the best place to look for a mine is in close proximity to an existing one. This morning Pretium purchased the King Tut,Tuck and Silver Crown West properties off Teuton for $1.8 million and a 2% NSR.

King Tut and Tuck properties adjoin due south of Pretium's Brucejack property which hosts 6.9 million (P+P) ounces of gold at 15.7 grams per tonne. One of the richest large undeveloped gold projects in the world. At $1100 gold the project generates an after tax IRR of 28.5%.

One drill in 2012 on the King Tut property intersected 222 metres running 0.88 gram per tonne (g/t) gold showing the potential for gold mineralization.

Teuton at the end of March had $113,637 in cash and has since closed about $600k in financings.

The $1.8-million is payable as follows: $100,000 upon signing; a further $150,000 on or before Aug. 15, 2015; a further $250,000 on or before Jan. 14, 2016; a further $250,000 on or before July 14, 2016; a further $250,000 on or before July 14, 2017; a further $400,000 on or before July 14, 2018; and, a further $400,000 on or before July 14, 2019.

D. Cremonese, P.Eng., President, commented as follows: "We are pleased to have optioned off three of our more than thirty properties in the Golden Triangle to a company of the caliber of Pretium Resources. The 2% NSR without a buyback ensures that we will retain a significant interest in any discoveries made on the optioned ground. Going the NSR route also has the advantage of saving on future dilution of equity."

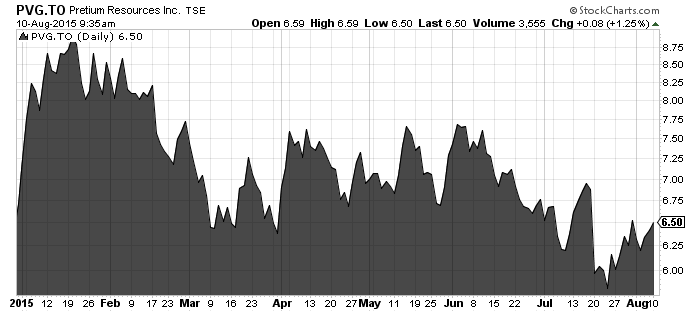

A smart move by Pretium picking up the claims adjacent to Brucejack. I talked to Pretium at the recent Sprott-Stansberry Symposium and financing (debt,royalty, equity) and construction appear imminent.

Federal environmental permits were received on July 31st leaving MA and EMA permits which are expected before the end of the summer.

If everything goes according to plan Pretium will be in commercial production in 2017.

Read: Teuton Resources optioning three properties to Pretium

Related: Pretivm (PVG.TO) intends to be a dividend payer: CEO Robert Quartermain

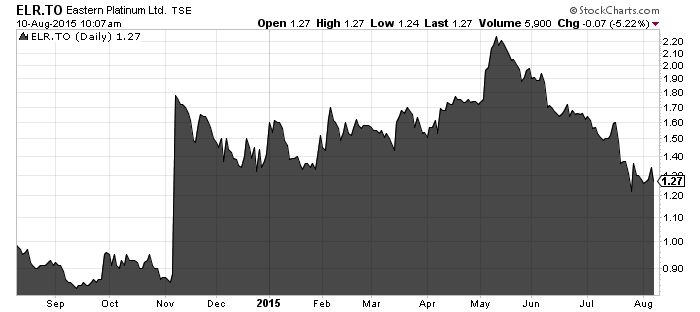

Eastern Platinum - (ELR:TSX) - Eastern Platinum has extended the closing of the transaction with Hebei Zhongbo Platinum Co. Ltd from from Aug. 7, 2015, to Dec. 31, 2015. The deal was originally struck on November 7th last year and was expected to "close within three to six months".

ELR states that the deal still remains subject to the execution of definitive agreements and the receipt of all necessary South African regulatory approvals.

I would be especially wary of the this transaction as an investor now that the closing has been delayed twice. Also of note is that platinum price is down from ~$1200 when the deal was made to $974 per ounce this morning.

ELR stock below the share price spike on the day in which the deal was announced after hitting a high of close to $2.20 in late May.

Harrington Global Ltd has been buying the stock in the open market hoping the deal would go through and can not be happy with the latest news.

Harrington owns 19.4% of the 92,639,032 outstanding shares and was buying as high as $2 per share.

At the end of June the balance sheet shows ~$64 million in cash and short term investments at ELR.

Read: Eastern Platinum extends Hebei deal deadline

Related: Unexpected windfall for Eastern Platinum investors

Thanks for reading.

This is not investment advice. All facts are to be checked and verified by reader. As always please do your own due diligence.