Few majors and juniors are willing to deploy exploration capital in this market but even less are prepared to prospect on virgin ground. One junior Company with a mandate to pursue grassroots exploration is Westhaven Ventures (westhavenventures.com). Westhaven (TSX.V – WHN) is the vehicle legendary prospector Grenville Thomas and his team are using to define what may be both a new nickel district and epithermal gold discovery in British Columbia.

Mr. Thomas is no stranger to prospecting and generating phenomenal returns for his shareholders. He is most commonly cited for his diamond discovery through Aber Resources in the Lac de Gras area which is now the Diavik diamond mine, Canada’s largest and richest diamond mine. That discovery took shareholders on a run from $0.60 to a high of $51.00 which is exactly why Mr. Thomas enjoys the excitement of prospecting and what he plans to replicate for Westhaven.

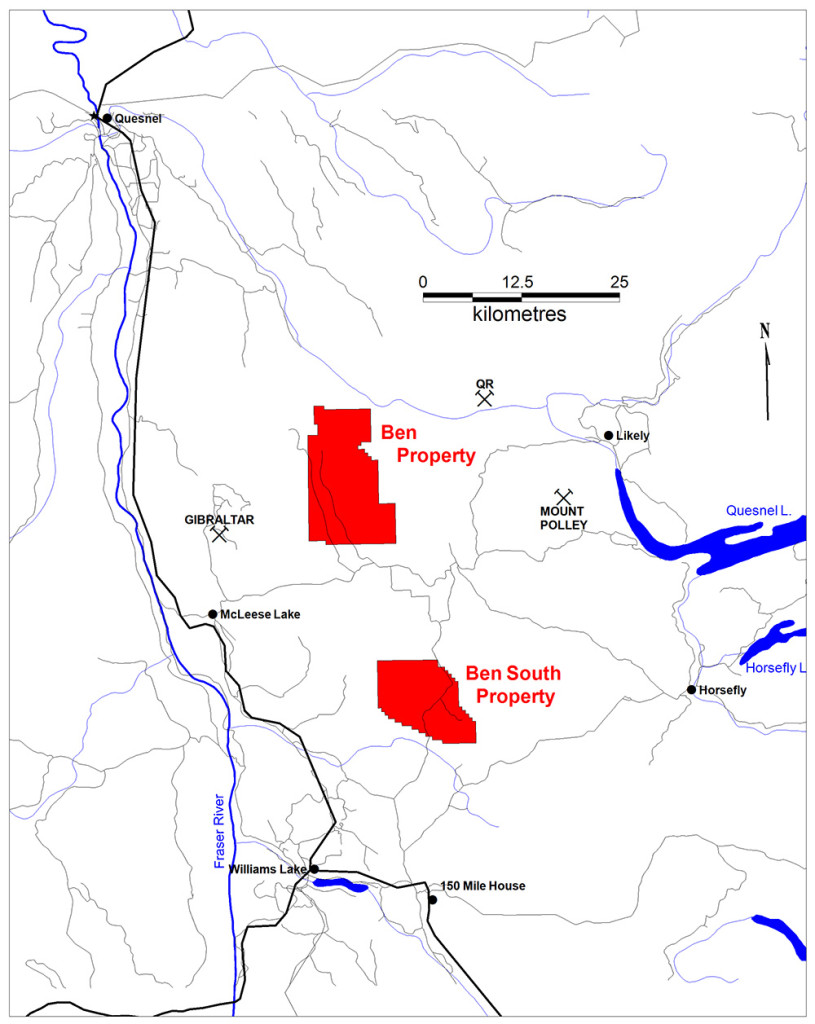

The company has three assets in British Columbia. The Ben and Ben South are nickel projects located in central B.C., 50 km’s north of Williams Lake. The other prospective property is the Shovelnose gold project a few hours outside of Vancouver just before Merritt. One of the key advantages of these properties is the infrastructure surrounding them which allows you to literally drive off the highway onto the project. This translates into greatly reduced exploration costs as you do not have to fly in gear or build camps.

The Ben nickel project received substantial attention last year after the Company announced the results of its inaugural drill program at the property. Only 3 holes were drilled for a total of 425 metres and the 3rd hole hit 70.6m @ 0.31% Nickel and 0.012% Cobalt starting at bedrock surface. The amusing thing about this is that they were looking for gold!

Since then, Westhaven has gone on to complete two more drill programs and 20 more drill holes across 4 distinct zones. Management is confident they can prove up a very sizable tonnage of nickel that has already undergone a round of metallurgical testing. Shaun Pollard, Westhaven’s CFO, stated, “Before we drilled out a resource, we wanted to be confident that the nickel can be liberated and a marketable concentrate produced.” They announced the positive metallurgical results in May of this year.

Clearly, there is a substantial amount of work to do but nickel sulphide discoveries of this potential size in safe jurisdictions near infrastructure are hard to come by these days.

Westhaven Ventures in office drill core: hole BN 14-19 - 153.7m of 0.18% Ni & 0.01% Co (Source: Author)

Westhaven believes that the Ben project has the potential to be of similar size, if not bigger than Royal Nickel’s Dumont project in Abitibi, Quebec. The Dumont nickel project hosts 1.17 billion tonnes at 0.27% Ni for a resource of 6.9 billion lbs Ni, situated along a 7.65Km trend. When Dumont is put into production it will rank as the fifth largest nickel sulphide operation in the world.

The Dumont deposit is well defined by magnetics, a geophysical tool that is heavily employed at the Ben as well. Targeting magnetic anomalies has proven very effective at the Ben and there are several huge anomalies that have been outlined to date. The Northern Lobe zone is a magnetic anomaly that is over 7.5km’s in length and pinches and expands between 200 and 1000 metres in width. The Company has a couple drill holes into this zone and has confirmed that there is nickel sulphide there. This is only 1 of the 4 zones outlined and drilled to date. The aim is to prove that the Ben property hosts a large tonnage of economically recoverable nickel and potentially put British Columbia on the map for something other than copper, coal or gold.

Forest fires and drought conditions across the province have slowed Westhaven’s exploration efforts across all of its BC projects due to safety concerns and the added cost of having to truck in water. The work programs for the projects are now planned for early fall and will involve geophysics which will assist in pinpointing where Westhaven should be placing their drills to continue to prove up the size potential on the property.

When speaking with Mr. Pollard about the geophysical work he noted, “By targeting magnetics, there’s a near perfect correlation to us hitting nickel material. The magnetic anomalies are both sizable and numerous. What gets us excited about this project is that it is 153 km² and the property has only seen 2,600m of diamond drilling providing immense exploration upside. We like that. We’ve barely scratched the surface.”

Management is aligned with shareholders shown through the 55% ownership in the company. Westhaven has strong financial stewardship by incurring only $16,000/month in G&A expenses. All officers & directors of the company only receive $100,000 in aggregate for salaries annually which is represented in the monthly burn rate. Management intends to make their money as a result of share price appreciation, not salaries.

One of the benefits of a depressed exploration market is that exploration costs have fallen for companies. Westhaven is budgeting all-in diamond drilling costs at $140/metre which includes assays, labour and associated expenses. Westhaven’s low drilling costs are also a function of their projects locations. In more remote areas, it’s not unusual for drilling costs to be 2-3x what Westhaven’s are.

Westhaven is also planning to be active exploring their Shovelnose gold project this fall. It’s located in the Spences Bridge Gold Belt just south of Merritt and it is Management’s belief that it has the potential to host high grade gold mineralization. There is evidence of a significant mineralized alteration system within the property and with float samples grading 119 g/t gold and veins in trenching grading 66 g/t gold, there’s a lot to get excited about. I will be following up on Westhaven’s Shovelnose project with a site visit in the near future.

Symbol: TSX.V – WHN

Price: $0.06

Market Cap: $1.63M

Shares Outstanding: 27.21M

DISCLAIMER: The work included in this publication is based on SEDAR filings, current events, interviews, and corporate press releases. It may contain errors, and you shouldn’t make any investment decision based solely on what you read here. This publication contains forward-looking statements, including but not limited to comments regarding predictions and projections. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. The views expressed in this publication and on the CEO.CA website do not necessarily reflect the views of Pacific Website Company Inc. or the author. The author holds no shares in Westhaven Ventures and has received no compensation for this article. This publication is provided for informational and entertainment purposes only and is not a recommendation to buy or sell any security. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies such as Westhaven Ventures can easily lose 100% of their value so read Westhaven Venture’s profile on www.SEDAR.com for important risk disclosures. It’s your money and your responsibility.