After flying into Mayo, central Yukon, from ATAC Resources (Part 2) we packed into a shuttle van to head toward the Keno Hill Silver District. Keno Hill is an extraordinary part of the Yukon; it is the largest and richest silver district in Canada. From 1913 to 1989 there were 35 producing mines which yielded 217 million ounces of silver, a value of $3.3B today, with a remarkable average bonanza grade of 1,369 GPT Ag. This puts the Keno Hill district in the top 3% of global silver producers in terms of grade produced. It also supported the Yukon economy after the Klondike gold rush (Part 1).

After a brief 45 minute drive we arrived at Alexco Resource (TSX: AXR) (NYSE: AXU), a past producer of high grade silver which has temporarily suspended operations due to weak silver prices. We joined the Alexco team at their on-site office to hear Clyton Nauman, President & CEO, explain how the company is transitioning back into a high grade Canadian silver producer.

Alexco owns 100% of the Keno Hill Silver District, a 244km² property position, and the Bellekeno silver mine. Bellekeno went into production in 2011 at the peak of the silver market and was profitably producing until 2013. During operations Bellekeno was one of the world’s highest grading silver mines with a production grade up to 1,000 GPT Ag.

With the current halt Alexco is repositioning the District for long-term, sustainable operations. The District is located in the Traditional Territory of the Na-cho Nyak Dun, with whom Alexco have been in discussion from early exploration to development, and most recently past production. An existing Comprehensive Cooperation and Benefits Agreement (CCBA) guides the interactions between Alexco and Na-cho Nyak Dun. NND are innovative and proactive; they have chosen to commercially participate as providing food service catering and as a joint venture partner with Procon for underground mining at the Alexco project.

Alexco is rapidly exploring other promising high-grade silver prospects on its District property. The company recently made the Flame & Moth discovery, one of the largest deposits ever in the District, which points to the prolific and prospective nature of Keno Hill. The team at Alexco have been successful in growing their resource since 2008. Their exploration efficiency has seen indicated silver resources grow from 10M Oz Ag in 2009 to now 55M+ Oz Ag indicated and 12M+ Oz Ag inferred.

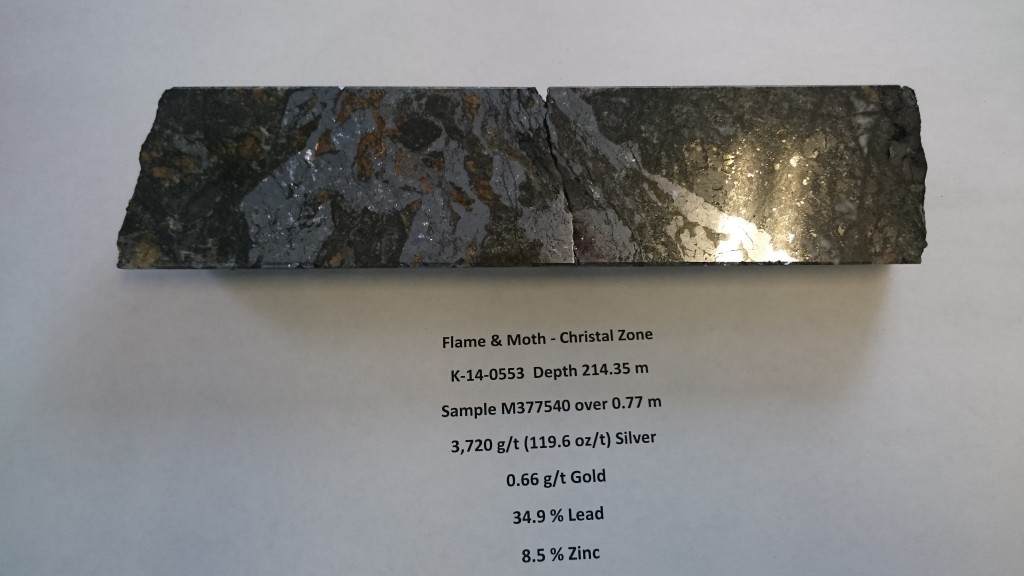

Alexco’s uber high grade Flame & Moth – Christal Zone core – 3,720 GPT Ag over 0.77m. Don’t make the mistake I made believing this is native silver, what you are viewing is the element galena, a look alike!

The average cost of discovery for Alexco has been favourable - $0.60 per ounce of silver discovered. The Flame & Moth deposit added approximately 27M Oz Ag indicated at an average grade of 506 GPT Ag. This deposit is comprised of the Christal Zone, Lightning Zone, and F&M West zone. These are all conveniently located within walking distance to the mill and will be Alexco’s cornerstone asset for 6 years of production. With this substantial discovery management is focused on obtaining the permitting, engineering, and construction to develop and produce from the Flame & Moth deposit.

Mr. McOnie, VP Exploration, explains the plans as we stand in front of the portal to access the Flame & Moth – Christal zone. Alexco’s newest and largest silver discovery.

Another key objective is to ensure future “All In Sustaining Costs” (AISC) are competitive compared to the silver spot price. In 2013 Q2 AISC were approximately $19.00/Oz, they have a targeted AISC of $15.00/Oz. Clynton Nauman, President & CEO stated, “We would like to see silver prices back at the $20.00/Oz level or higher, then that would be a no brainer for us to switch back on to production. We have all the necessary infrastructure in place to do so along with our mill on care and maintenance.”

Alexco proposes to reduce the AISC per ounce of silver by optimizing the operating plan. Critical to this plan is ensuring 400 tonnes per day mill throughput, previously averaged 250 TPD between 2011-2013. That will be accomplished by mining ore sequentially from Bellekeno, Flame & Moth, and the Lucky Queen ore deposits. The PEA estimates a small $20M CAPEX with annual average production of 3M Oz Ag at an average grade of 754 GPT Ag. This places Alexco in the top quartile by grade amongst its peers.

Alexco’s fully built processing plant. Currently on care & maintenance. It is production ready and can be turned back on with the flick of a switch. Click for full size.

Annual average production will also include approximately 13M lbs Pb & Zn. Silver Wheaton, the world’s largest silver streamer, has a 25% silver stream on production where it will pay between $3.90-$18.00/Oz Ag produced depending on the spot price.

Touring the Alexco mill. Alexco will be quick to restart production once silver prices rise to a profitable level.

Alexco is not your typical mining company. It has a unique business model which provides mine-related environmental services, remediation technologies, and reclamation and mine closure services to both government and industry clients through the Alexco Environmental Group, its wholly-owned environmental services division.

AEG is a well branded and growing business which brought in $14.9M, 98% of total revenues for fiscal 2014. Management claims to have $100M+ worth of backlogged business. This provides the necessary cash flow required to wait out the current low silver price environment.

Alexco is also the only production ready company we visited on the media tour. It stood out from the exploration and development stage projects by way of infrastructure. You can drive onto and around the property via all-weather roads - a big advantage in the Yukon from a logistical and cost saving point of view. In addition, the mill plant gets its energy from the Yukon electric grid, a stable source of power.

While Alexco waits for higher silver prices in the near future, the management group continues to advance their project. The company will be working toward permitting the Flame & Moth deposit, continuing to optimize the existing PEA to lower AISC for silver production to economic levels, and growing existing resources through exploration around their highly prospective District.

If you are looking for a Canadian asset in a safe jurisdiction with established infrastructure that will provide significant leverage to a rising silver price, Alexco Resource fits those criteria. They have a cash generating subsidiary along with $7.5M in cash to wait out the current market slump. The world’s largest silver streaming company, Silver Wheaton, sees opportunity in this project. And Sprott Global Investments’ Rick Rule is a major shareholder.

After the Alexco tour wrapped up we shuttled back to the Mayo airport and flew to Destruction Bay, on the south west corner of the Yukon. If you’re wondering about the name, the town was literally blown over when it was first built. Come back tomorrow to hear about Part 4 and the Wellgreen Platinum site visit.

Symbol: TSX – AXR

Price: $0.445

Market Cap: $30.97M

Shares Outstanding: 69.47M

DISCLAIMER: The work included in this publication is based on SEDAR filings, current events, interviews, and corporate press releases. It may contain errors, and you shouldn’t make any investment decision based solely on what you read here. This publication contains forward-looking statements, including but not limited to comments regarding predictions and projections. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. The views expressed in this publication and on the CEO.CA website do not necessarily reflect the views of Pacific Website Company Inc. or the author. The author holds no shares in Alexco Resource and has received no compensation for this article. This publication is provided for informational and entertainment purposes only and is not a recommendation to buy or sell any security. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Resource companies such as Alexco Resource can easily lose 100% of their value so read Alexco's profile on www.SEDAR.com for important risk disclosures. It’s your money and your responsibility.