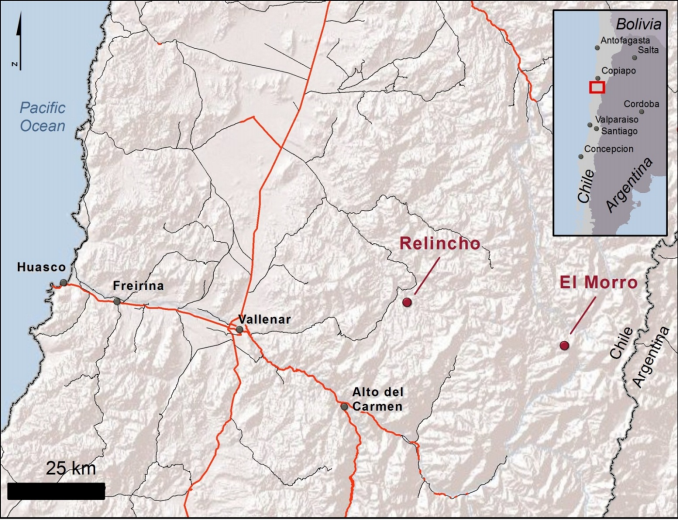

Map of the Relincho and El Morro projects which will now be called Project Corridor (temporary name) and 50% owned by each Goldcorp and Teck Resources.

A look at a few of the mining press releases that caught my eye this morning and some additional thoughts.

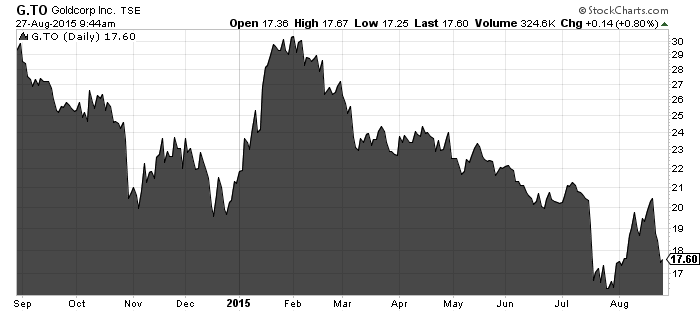

Goldcorp (G:TSX), Teck Resources (TCK.B:TSX), and New Gold (NGD:TSX) - A couple deals this morning by Goldcorp on the same asset the El Morro copper-gold project in Chile. The first involves buying the 30% interest owned by partner New Gold for $90 million and a 4% gold stream. The second transaction involves partnering with Teck Resources on a 50/50 basis on El Morro and the Relincho project also in Chile.

El Morro and Relincho will now be considered as one project and will be renamed Project Corridor. Proven and probable reserves of Project Corridor would contain approximately 16.6 billion pounds of copper, 8.9 million ounces of gold, and 464 million pounds of molybdenum.

Project Corridor will now be one of the largest undeveloped copper-gold-moly project in the Americas.

The projects will benefit from many synergies but still will be expensive to build with an estimated $3.5 billion CAPEX down from $4.5 billion in 2013 dollars.

The partners will be working with all communities regarding project development.

A pre feasibility study is expected to commence in early 2016 and take 12-18 months.

"This transaction allows us to consolidate the ownership of El Morro and work with Teck to jointly develop the Relincho and El Morro deposits in a way that is expected to deliver significant synergies to our respective stakeholders and shareholders," said Chuck Jeannes, Goldcorp's president and chief executive officer.

"Combining these two neighbouring assets is a common sense approach that allows us to consolidate infrastructure to reduce costs, reduce the environmental footprint and provide greater returns over either standalone project," said Don Lindsay, President and CEO of Teck.

At first glance to me this looks like a win/win/win deal for all three companies involved.

The synergies of Goldcorp and Teck working together could result in substantial cost savings hopefully making the project economically viable in the future.

Goldcorp stock to me looks interesting at the $17-$18 level especially if your bullish on gold.

Goldcorp has one of the cleanest looking balance sheets of the large gold producers. I believe they have to be actively looking at acquisitions.

Two companies that would be at the top of the list if I was Mr. Jeannes would be Detour Gold and Pretium Resources.

Read: GOLDCORP AND TECK COMBINE EL MORRO AND RELINCHO PROJECTS IN CHILE

Related: Goldcorp’s next takeout

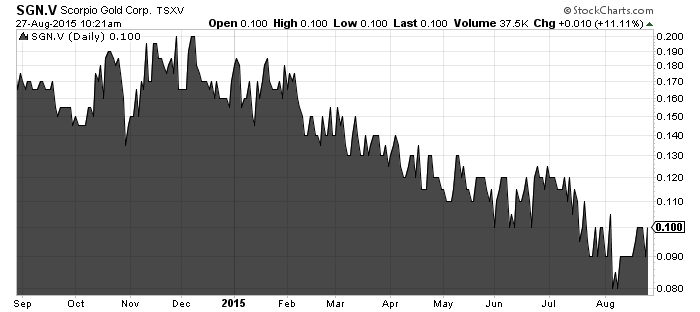

Scorpio Gold (SGN:TSXV) - Scorpio Gold is out with second quarter financials showing earnings of $1.7 million at the Mineral Ridge mine in Nevada. Nice to see a small junior producer make a profit.

Scorpio delivered to shareholders a profit in the quarter which many gold producers can not say they did. Even though operations are small with only 8,738 ounces produced.

Scorpio will need to find more ounces though as a 2014 life of mine study projected mine life into the third quarter of 2016.

Peter Hawley, President & CEO, comments, "The Company continued its consistent performance with another strong quarter at Mineral Ridge, and is well on track to meet its 2015 production forecast of 40,000 to 45,000 ounces of gold produced at a cash cost of $800 to $850 per ounce of gold sold. Operational excellence remains the Company's key focus, and with the new mining plan developed in mid-July, the Company will focus its production efforts on lower strip ratio areas at the Mineral Ridge mine with high quality ounces to offset the depressed gold price, in an effort to ensure continued performance through the second half of 2015. We are very proud of our Mineral Ridge operations team, which continues to deliver solid results despite a difficult time in the mining sector."

A steady decline in $SGN stock since the beginning of the year.

Investors are worried about the gold price and extending the mine life at Mineral Ridge.

SGN is also running low on working capital with only $700k as of June 30th but they do have $3.8 million in "metal in process inventory"

Read: Scorpio Gold Reports Financial Results for Second Quarter of 2015

Thanks for reading.

This is not investment advice. All facts are to be checked and verified by reader. As always please do your own due diligence.