A flurry of news releases to start the month of September. I take a look at a few of what I consider to be the top headlines and provide a link to a few others.

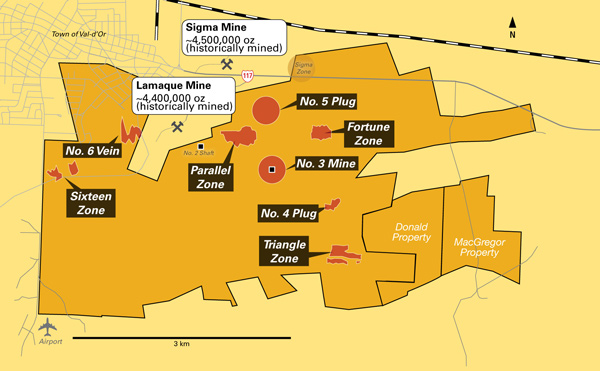

Integra Gold - (ICG:TSXV) - Integra Gold is out with final drill results from the winter/spring program at the Lamaque South gold project located in Val d'Or, Que.

Integra has been one of the more active junior companies in 2015 completing 128 holes (52,432m) this year so far at Lamaque.

Three drill rigs remain drilling with 5 more to be added again soon.

The focus for Integra remains on adding reserves at the Triangle Zone. Triangle currently has an indicated resource of 441,580 ounces at 10 g/t gold and 152,370 inferred ounces at 11 g/t gold.

Triangle is the largest of the 6 zones in Integra's resource estimate and accounts for over half of the total resource at Lamaque South.

Drill results today were from the last 6 holes at Triangle (4,149m) and is highlighted by hole TM-15-22 intersecting 6m of 13.95 g/t gold.

Selected significant drill intercepts include:

| Drill Hole | From (m) |

To (m) |

Interval (m)* |

Gold Assay (g/t)** |

Interpreted Zone |

| TM-15-10A | 687.00 | 688.00 | 1.00 | 6.83 | C4 |

| TM-15-11A | 617.00 | 625.00 | 8.00 | 3.70 | C4 |

| TM-15-22 | 27.60 187.50 222.00 239.00 538.00 |

29.60 190.00 229.00 245.00 544.00 |

2.00 2.50 7.00 6.00 6.00 |

8.56 7.78 1.44 13.95 12.86 |

C2 C4 |

| TM-15-36 | 165.00 506.00 515.00 |

166.00 511.00 517.00 |

1.00 5.00 2.00 |

9.40 2.74 11.31 |

C4 C4 |

"Drilling at Triangle consistently exceeds our expectations and the zone continues to show significant potential to grow. The steeply dipping "C" structures have expanded well beyond the limits of the intrusive host rock and previous resource estimate boundaries while, as predicted by our geological model, additional, sub-parallel and steeper "C" types structures, such as the C5 Zone, continue to be discovered," commented Company CEO and President Stephen de Jong. "3D modelling in preparation for an updated resource estimate at Triangle is progressing well and we expect to deliver the new resource estimate on Triangle in early Q4. The Company will be announcing plans for its 2016 drill program in the coming months as well as an update on surface preparation work and permitting for the Triangle decline which is progressing well."

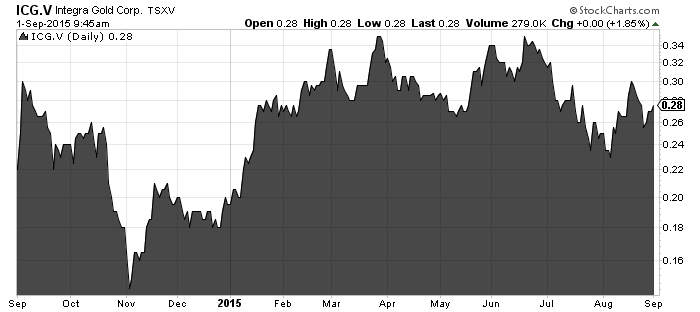

Integra stock had a great start to 2015 and has held up well in the $0.26-$0.34 range.

I think the market will be interested to see with all this drilling how much bigger the Triangle resource comes in at.

Plenty of news flow to come from Integra this year with drill assays and the resource estimate update on Triangle in early Q4.

Related: Resource Maven: Eldorado Investment Shines Spotlight on Integra Gold

GoldMoney - (XAU:TSXV) - GoldMoney has released key performance indicators for its two operating platforms for the month of August.

The numbers look good at a first glance to me for the BitGold platform but are slightly down for the GoldMoney platform.

At BitGold all three measured metrics are higher. At GoldMoney a discouraging sign is that funded accounts are decreasing and transaction volume as well. One bright side is that assets under administration increased by $43 million but this is likely due to a 3% move in gold in August.

BitGold Key Performance Indicators:

User Sign Ups

|

Period |

Total User Signups – End of Period |

Net Increase/Decrease |

|

August 2015 |

242,264 |

+74,262 |

|

July 2015 |

168,002 |

+105,373 |

|

June 5th to June 30th 2015 |

62,629 |

+29,615 |

|

Launch to June 4th 2015 |

33,014 |

+33,014 |

Transaction Volume (Gold Grams) 1

|

Period |

Transaction Volume– End of Period (grams) |

Net Increase/Decrease (grams) |

Value in CAD for Reference |

|

August 2015 |

243,427 |

+90,318 |

C$ 11,798,926 |

|

July 2015 |

153,109 |

+74,226 |

C$ 7,069,042 |

|

June 5th to June 30th2015 |

78,883 |

+45,002 |

C$ 3,479,889 |

|

Launch to June 4th 2015 |

28,881 |

+28,881 |

C$ 1,359,428 |

Customer Gold in Vaults (Gold Grams) 2

|

Period |

Gold in Vaults – End of Period (grams) |

Net Increase/Decrease |

Value in CAD for Reference |

|

August 2015 |

180,366 |

+62,159 |

C$ 8,745,947 |

|

July 2015 |

118,207 |

+54,652 |

C$ 5,457,617 |

|

June 5th to June 30th2015 |

63,555 |

+39,178 |

C$ 2,993,400 |

|

Launch to June 4th 2015 |

24,377 |

+24,377 |

C$ 1,147,681 |

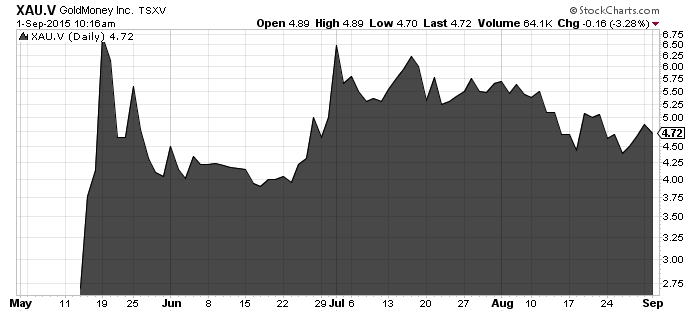

The initial hype and buzz surrounding BitGold (GoldMoney) has slowed since the IPO. The stock is holding in fairly well though in the high $4 dollar range.

Investors will be looking at second quarter financial results to determine if XAU can support the $204 million dollar market cap it currently has. First quarter financials were released last night and show a net loss of $2.8 million in 56 days of business activity.

Interesting technology to say the least. I have yet to signup for an account yet but I hear A. Nelson has and I am awaiting the coffee he promised to buy me with gold!

Read: GoldMoney Inc. Reports August Key Performance Indicators for the BitGold and GoldMoney Businesses

Related: Buy your next coffee with gold: GoldMoney (TSX.V – XAU)

Other press releases links

- Northern Dynasty signs definitive deal for Cannon Point

- Tintina Resources working on Black Butte studies

- Aston Bay completes summer exploration at Storm

- Independence starts drill program at Boulevard

- Pretium receives all permits for Brucejack development

Also First Mining Finance, Gold Canyon, and PC Gold are all halted pending news.

Thanks for reading.

This is not investment advice. All facts are to be checked and verified by reader. As always please do your own due diligence.