Rick Van Nieuwenhuyse, CEO of NovaCopper Inc. (TSX, NYSE - NCQ), previously helped develop predecessor NovaGold Inc. into a leading gold exploration company with a multi-billion-dollar market capitalization and $19 stock at its highs.

He would like to repeat that success at NovaCopper, which is advancing a new potential mining district in Northwestern Alaska with state and First Nations partners.

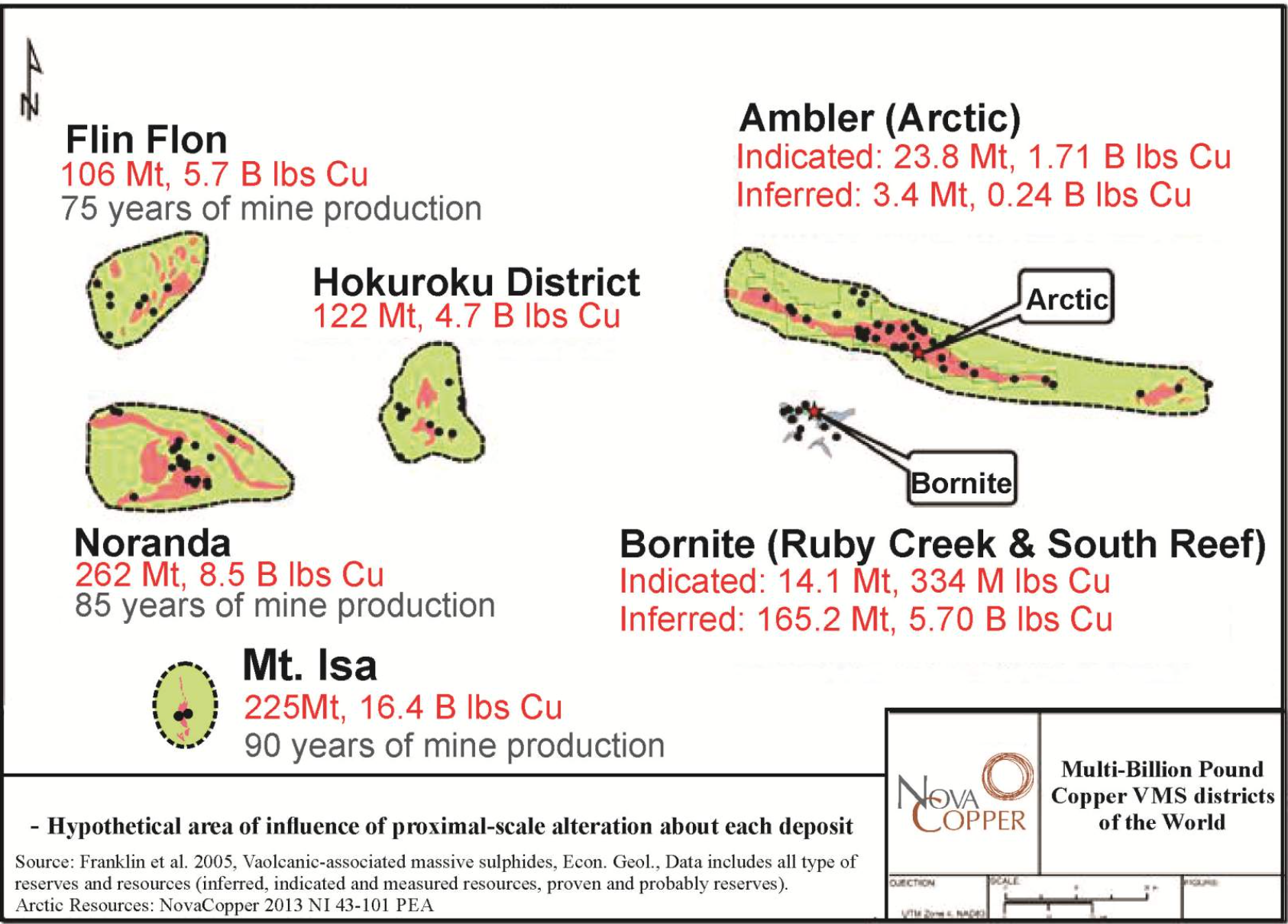

The company is focused on the Upper Kobuk Mineral Projects, also known as the Ambler mining district, for the Arctic and Bornite deposits. The region contains among the highest-grade undeveloped copper-zinc deposits in North America. Here Arctic and Bornite are compared to other well known copper VMS mining districts around the world:

NovaCopper has been quietly moving its district-scale project forward, having recently completed its 2015 field program at the Arctic deposit. The 3,055 metres of drilling, as well as geotechnical work and environmental base line studies, mark the start of pre-feasibility work for NovaCopper’s Arctic deposit on its 143,000-hectare land package in the Ambler mining district located in northwestern Alaska.

The company drilled a total of 14 diamond drill holes and results will be released in Q4. NovaCopper is also working with Alaska state agencies on environmental permitting for an industrial road between the mine site and the coast, an estimated 2.5-year process, and expects a decision on moving forward with EIS process before year end. There's a lot more on the story here.

NovaCopper’s Arctic and Bornite deposits, located 25 kilometres apart, host a combined 8 billion pounds of high-grade copper as indicated and inferred resources. When byproduct credits are included, the resource estimate grows to 9.5 billion pounds of indicated and inferred copper equivalent resources. The more advanced Arctic deposit hosts copper, zinc, lead, gold and silver ores and has an average grade of approximately 6% copper equivalent.

Twelve of the latest holes were infill holes designed to evaluate the continuity of copper-zinc-lead-gold-silver mineralization and upgrade existing inferred resources to the measured and indicated categories. The other two holes were geotechnical holes drilled to support slope design of the open pit as well as guide pre-feasibility planning. Ten drill holes had piezometers installed for hydrological test work and data collection.

In addition to the drilling, NovaCopper also conducted assessments of potential site infrastructure and waste management locations, and completed 34,000 acres of wetlands delineation within the project area.

NovaCopper’s partners are NANA Regional Corporation (NANA), an Alaska Native corporation, and the Alaska Industrial Development Export Authority (AIDEA), a State of Alaska government agency that is looking at building the road as a revenue-generating piece of infrastructure. NANA will own a net smelter royalty on mine production and also has the option to participate in the project (between 16% and 25%) as an equity partner by paying its share of all projects costs.

At CEO.CA’s Oct. 8 Subscriber Investment Summit in Vancouver, NovaCopper CEO Rick Van Nieuwenhuyse presented a long-term bullish case for copper, which has fallen from the US$3 level a year ago to the current $2.40. New copper deposits aren’t large or numerous enough to replace depleted production, he pointed out, and most green technologies also devour the red metal.

Goldman Sachs lowered its copper price forecasts in July, citing slowing Chinese demand. But other experts are more bullish: Wood Mackenzie is forecasting $2.70-2.80 copper through 2017, rising to $3.50 a pound as a supply shortfall kicks in around 2020. SNL Metals & Mining believes copper prices will bottom in 2015 and slowly rise to $3.85 per pound by 2020.

As of Aug. 31, NovaCopper had cash and equivalents of $18.4 million, which the company says is sufficient for the next two years of operations.

The company's shares trade on the New York Stock Exchange and Toronto Stock Exchange under the symbol $NCQ and are currently trading around all-time lows.

Read the news release: NovaCopper Completes 2015 Field Program on the Arctic Deposit and Announces Third Quarter Financial Results

Previous coverage: Not ambling: NovaCopper’s road to a major Alaskan mine

Watch for video from the Subscriber Summit later this week and next week, and join us in chat.ceo.ca - the investment conference in your pocket - 24/7 365.

Disclosure: I have been a buyer of NCQ under 55 cents recently and will benefit financially from appreciation in NovaCopper's share price. The company is also a sponsor of the Subscriber Investment Summit. These factors make me very biased in my coverage of the company. Junior mining stocks like NovaCopper are very speculative (risky) investments that can and often do go to zero - $0.00. Do your own due diligence and consult a licensed investment advisor prior to making any financial decisions. This website is provided for informational and entertainment purposes only and is not intended to be investment or professional advice of any kind. Read NovaCopper's profile on www.SEDAR.com to better understand the risks facing the company.

Cautionary Note Regarding Forward-Looking Statements

This article includes certain “forward-looking information” and “forward-looking statements” (collectively “forward-looking statements”) within the meaning of applicable Canadian and United States securities legislation including the United States Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical fact, included herein, without limitation, statements relating to development of the Ambler mining district and advancement of the Arctic deposit, are forward-looking statements. Forward-looking statements are frequently, but not always, identified by words such as “expects”, “anticipates”, “believes”, “intends”, “estimates”, “potential”, “possible”, and similar expressions, or statements that events, conditions, or results “will”, “may”, “could”, or “should” occur or be achieved. These forward-looking statements may include statements regarding perceived merit of properties; exploration plans and budgets; mineral reserves and resource estimates; work programs; capital expenditures; timelines; strategic plans; market prices for precious and base metals; or other statements that are not statements of fact. Forward-looking statements involve various risks and uncertainties. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from NovaCopper’s expectations include the uncertainties involving the need for additional financing to explore and develop properties and availability of financing in the debt and capital markets; uncertainties involved in the interpretation of drilling results and geological tests and the estimation of reserves and resources; the need for cooperation of government agencies and native groups in the development and operation of properties; the need to obtain permits and governmental approvals; risks of construction and mining projects such as accidents, equipment breakdowns, bad weather, non-compliance with environmental and permit requirements, unanticipated variation in geological structures, metal grades or recovery rates; unexpected cost increases, which could include significant increases in estimated capital and operating costs; fluctuations in metal prices and currency exchange rates; and other risks and uncertainties disclosed in NovaCopper’s Annual Report on Form 10-K for the year ended November 30, 2014 filed with Canadian securities regulatory authorities and with the SEC and in other NovaCopper reports and documents filed with applicable securities regulatory authorities from time to time. NovaCopper’s forward-looking statements reflect the beliefs, opinions and projections on the date the statements are made. NovaCopper assumes no obligation to update the forward-looking statements or beliefs, opinions, projections, or other factors, should they change, except as required by law.