A look this morning at news from McEwen Mining and Integra Gold, with some additional comments on each. An interesting connection between the two is Integra's open-data Gold Rush Challenge, which was inspired by Rob McEwen's pioneer Goldcorp Challenge 15 years ago while McEwen was CEO there.

McEwen Mining (MUX:TSX) - McEwen is out with a feasibility study on the Gold Bar project in Nevada. The study shows a 20% IRR at $1150 gold and will produce 65,000 ounces a year over a 5-year mine life. The plan is for an open-pit heap leach mine of between 0.80-0.95 grams per tonne gold.

Highlights of the Feasibility Study

- Estimated initial capital expenditures of $60 million

- Pay-back period of 3 years at $1,150/oz gold and 2 years at $1,300/oz gold

- After-tax IRR of 20% at $1,150/oz gold and 36% at $1,300/oz gold

- Average annual gold production of 65,000 oz at a cash cost of $728/oz

- Owner operated open pit mine with run-of-mine oxide heap leach processing

- Life-of-mine (LoM) ore production of 13 million tons at a diluted gold grade of 0.032 opt (1.1 gpt) resulting in 325,000 oz payable gold

- Updated in-pit resource estimate: 611,000 oz M&I and 111,000 oz Inferred

“Completion of this Feasibility Study is an important milestone. I believe Gold Bar will be the next mine we put into production. It includes the fundamental elements we consider important to investors when building a mine: Low capital and operating costs, and a reasonable rate of return in the current price environment. We can now move ahead with a high degree of confidence in the capital estimate and projected operating performance,” said Chairman Rob McEwen.

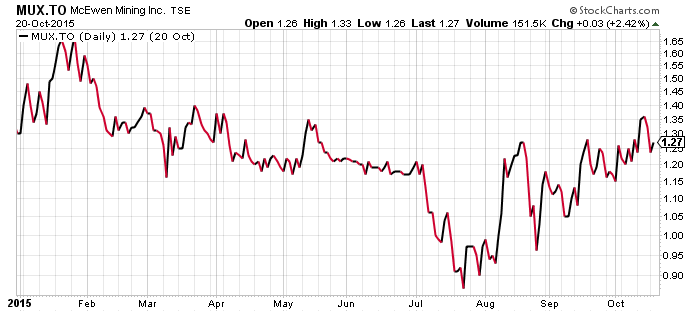

McEwen Mining has had a nice upward move since the beginning of August, a common theme in the gold complex as the yellow metal's price has risen.

Today's news is positive for MUX shareholders as Gold Bar has a low capital cost of $60 million and generates a healthy 20% IRR at current gold prices. The project also has tremendous leverage to gold, with an IRR of 36% at $1300 gold.

Next steps for Gold Bar include a record of decision from the Bureau of Land Management in Nevada, which is expected in January 2017. If all other permits are acquired, construction is expected to take just under a year.

Rob McEwen, who owns 25% of MUX stock and takes no salary, has been an active investor in several other gold companies in the last several years. His most recent purchase was on Monday, when he purchased 9,090,910 units of the Goldquest (GQC:TSXV) private placement.

McEwen Mining is generating positive cash flow and pays a 1 cent dividend, semi-annually.

As of Aug. 4, MUX had cash, cash equivalents and precious metals of $32 million.

Read: McEwen Mining Announces Positive Feasibility Study for Gold Bar Project, Nevada

Integra Gold - (ICG:TSXV) - One of the busiest companies (work-wise) on the TSX Venture this year is out with another update for shareholders. The primary focus of Integra's news was a progress update on the Triangle Zone at the Lamaque project in Quebec.

Work is being completed to prepare the Triangle Zone for an underground exploration program in 2016.

"We've been fortunate to have had such a successful exploration program this year and we are happy to announce today that we have concurrently made significant progress in preparing the Triangle Zone for future underground exploration. It was our plan to complete this surface work prior to the onset of winter. This work is now 80% complete, on-time and within budget. Local companies and contractors have provided competitive bids and we are impressed with the expertise shown and the quality of work conducted by the consortium of contractors," said Stephen de Jong, President and CEO. "This preparation work has not slowed our commitment to the Company's exploration program as we continue to explore across the property with five drills currently turning and up to 100,000 meters of surface drilling planned for 2016."

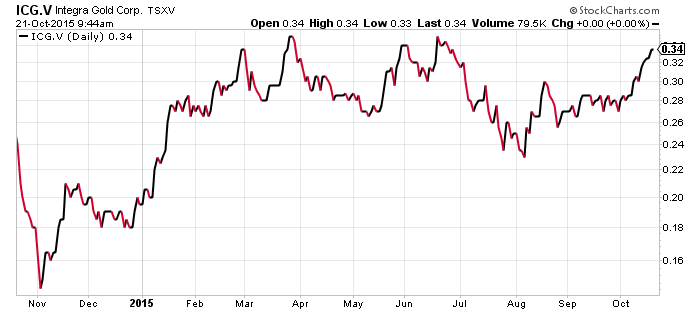

One of the best-looking charts in 2015 of any junior gold company, with a slow and steady rise over the last 11 months. CEO de Jong and his team have done a fantastic job of creating shareholder value this year by moving the project forward.

There's plenty of news flow still to come from $ICG, including an updated resource estimate due this quarter. An updated PEA is also expected in the first half of 2016.

The balance sheet remains strong with $26 million in cash as of September 30.

Of note is that Osisko Gold Royalties recently purchased a royalty package from Teck for $28 million which included a 2-per-cent NSR on the Lamaque property.

Related: Gold mining big data play could make you a millionaire

Thanks for reading.

This is not investment advice. All facts are to be checked and verified by reader. As always please do your own due diligence.