Good morning. Here is a look at a few of the news releases that caught my attention this morning with some additional comments and thoughts.

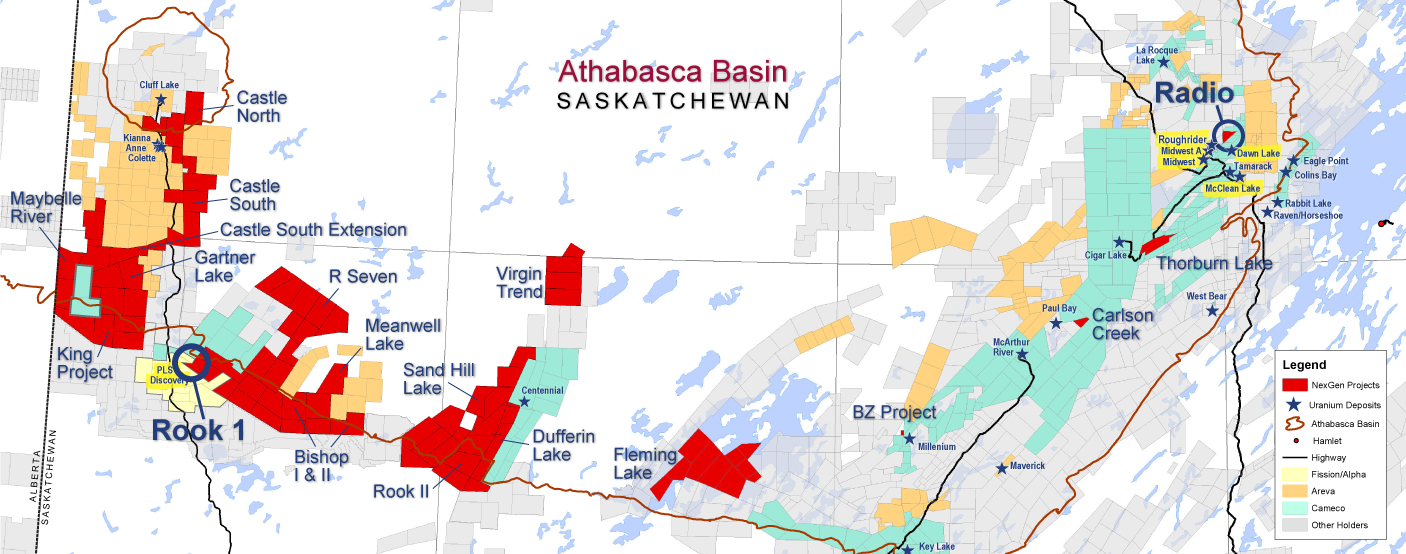

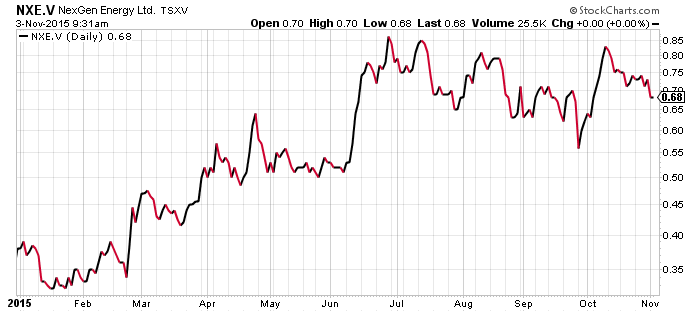

NexGen Energy - (NXE: TSXV) - NexGen continues to be one of the the most active mining companies on the TSX Venture, and its stock one of the best-performing. This morning NexGen released 5 holes from the summer drill program at the Rook 1 property in Saskatchewan. Assays continue to intersect high-grade uranium mineralization.

The deposit at Rook 1 continues to grow and investors will be eagerly anticipating an initial resource estimate scheduled to land in the first half of 2016.

Highlights:

A2 Shear

- AR-15-54c1 (87 m up-dip and southwest from AR-15-44b) intersected 27.5 m at 10.09% U3O8 (492.0 to 519.5 m) including 12.0 m at 20.01% U3O8 (500.5 to 512.5 m) and 2.5 m at 51.16% U3O8 (510.0 to 512.5 m) in the higher-grade A2 sub-zone.

- AR-15-53c2 (91 m down-dip from AR-15-44b) intersected 35.0 m at 4.88% U3O8 (576.0 to 611.0 m) including 6.0 m at 20.17% U3O8 (591.5 to 597.5 m) in the A2 shear.

A3 Shear

- AR-15-56c1 (225 m down-dip and to the southwest from AR-15-48c1) intersected 6.5 m at 12.06% U3O8 (721.5 to 728.0 m) and an additional 28.0 m at 1.14% U3O8 (770.0 to 798.0 m) in the A3 shear

- AR-15-51 (196 m down-dip and to the southwest from AR-15-48c1) intersected 25.0 m at 1.20% U3O8 (670.0 to 695.0 m) in the A3 shear

Garrett Ainsworth, Vice-President, Exploration and Development, commented: "These high-grade assay results from hole AR-15-54c1 are characteristic of the higher grade A2 sub-zone, which is thus far delineated across a 162 m strike length from northeast to southwest by holes AR-15-49c2, -44b, -62, -58c1, -54c1, and -59c2. All of these holes in the higher grade A2 sub-zone demonstrate strong continuity and grades that are constantly in excess of 10% U3O8 over wide intervals. In addition, the A3 has produced significant assay results with AR-15-51 and -56c1 producing strong mineralization across wide intervals."

NexGen's chart shows a steady rise for the stock, even in a weak uranium environment. Importantly, NexGen remains well funded with ~$18 million in cash.

Drilling is complete for the summer season, with some assays pending, and plans are underway for an extensive winter program beginning in January.

If you are attending Fabrice Taylor's Presidents Club conference in the Bahamas this weekend, NexGen will be exhibiting.

NexGen is actively discussed in CEO Live and all comments on the company can be found here.

Related: He shorted Bre-X. Now fund manager is going long NexGen

Klondike Gold (KG:TSXV) - Klondike Gold is drilling for dollars at its Indian River property as it drills for high-grade gold in Yukon. This morning the company announced receipt of $526,994 from a production royalty on the sale of placer gold from the McKinnon Creek property (within the Indian River land package), which is leased to Jerusalem Mining. That's Todd Hoffman's crew for the popular reality TV prospecting show GOLD RUSH.

It's a unique business model in the junior mining space, one that allows Klondike Gold to offset its costs as it continues the search for high-grade gold. Stated Peter Tallman, Klondike Gold's CEO: "The non-core Indian River placer asset has been turned around in the past two years into a cash-generating property with significant and increasing revenues of $0.5 million in 2015, following $0.2 million in 2014. Leasing Indian River has allowed the Company to focus on making significant bedrock gold discoveries on its core quartz claims underlying the western half of the Klondike goldfields.”

NR: Klondike Gold receives $0.5-million royalty payment for 2015

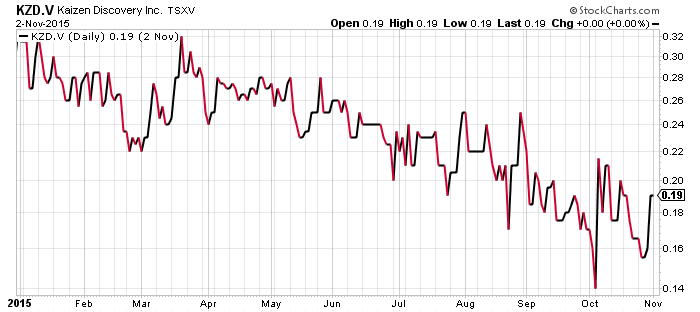

Kaizen Discovery - (KZD:TSXV) - Kaizen is out with final drill hole assays from the summer exploration program at the Aspen Grove Project in southern B.C. Mineralization was intersected in 12 of 13 holes. The target here is a copper-gold porphyry system.

Drill hole assay highlights from the Ketchan prospect include:

- 68 metres grading 0.40% copper and 0.34 grams per tonne (g/t) gold (0.65% copper equivalent) in drill hole K15-11;

- 26 metres grading 1.05% copper and 0.05 g/t gold (1.09% copper equivalent) in drill hole K15-10; and

- 72 metres grading 0.31% copper and 0.20 g/t gold (0.46% copper equivalent) in drill hole K15-03.

"We are very encouraged that drilling has yielded significant copper-gold mineralization over lengthy intervals throughout the Ketchan porphyry system, and in particular the presence of high copper and gold grades at shallow depths," said B. Matthew Hornor, President and CEO. "We plan to follow up next field season with a focused drilling program aimed at expanding these high-grade zones, utilizing funding already in place."

Kaizen has had a rough year share price wise, but is an extremely thin trader and could easily go up 50% or more on a significant drill hole.

I am sure management would have liked to see a significant drill hole this summer but this was not the case. It is extremely rare to hit significant mineralization on the first drill holes of an exploration program. That being said, many companies obviously drill what they think are the best-looking targets first. Geology is a tricky business.

KZD is intersecting mineralization which is a good sign. The company has strong partners and it will be interesting to see what 2016 brings.

Cash balance was $4.4 million as of June 30.

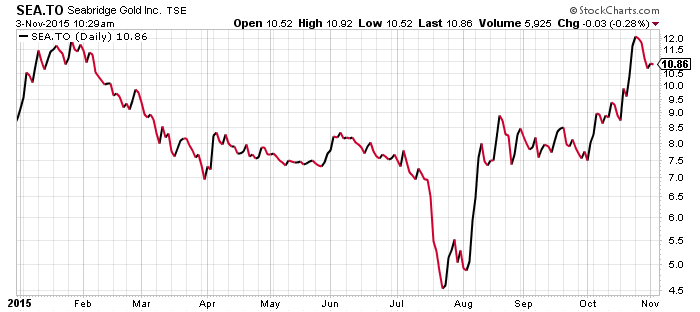

Seabridge Gold (SEA:TSX) - Seabridge Gold continues to find mineralization at the monster KSM project in northwestern British Columbia. The final two holes from the Deep Kerr zone were released this morning.

KSM is already 38.2M oz of gold and 10B pounds of copper. The only issue here is at today's metal prices it is uneconomic to build with a $5.3-billion dollar capex.

Leverage per share to higher metal prices is phenomenal though, with only ~52 million shares outstanding.

The following table summarizes the significant drill hole intersections for K-15-49B and K-15-50A.

Seabridge Chairman and CEO Rudi Fronk commented that "every time we drill Deep Kerr, we increase both the mineralized material in hand and the potential upside. This year, we achieved our aim of increasing the size and confirming the continuity of mineralization at our proposed block cave operation at Deep Kerr. We are confident that the results will substantially increase resources. At the same time, we also learned that grade increases at depth, especially for gold, and that we still have not found the limits of the deposit. We are also becoming more intrigued with the high grade potential of the less-explored east limb. Our focus at the moment is on enhancing the near-term value of KSM but the big picture continues to unfold in a most exciting way. The more we learn about KSM, the less we know about its limits."

Seabridge stock is back to levels found earlier in the year. The spike in share price in October has been a result of a heavy newsletter promotion from writers at Stansberry Research. I have received several emails in my inbox touting a gold stock with 10-bagger potential, which from the clues I know is Seabridge.

If you want leverage to copper and gold, it's hard to find a better stock than Seabridge.

The company has >$10 M in working capital according to the October presentation, plus $14.58M that closed near the end of October.

Read: Seabridge Gold expects this year's Deep Kerr drill results to add resources

Join the conversation about your favourite stocks and tap into some sharp insight at CEO Chat daily.

This is not investment advice and all investors should do their own due diligence. Own your trades.