A look at news releases from mine developer Torex Gold and producer Newmarket Gold this morning.

Spot gold is at US$1,107 per ounce as investors/traders await a crucial day for gold with the nonfarm payrolls and unemployment rate on tap for tomorrow morning.

Torex Gold -(TXG:TSX) - Torex has released 3rd-quarter financial results and a progress update at the El Limon-Guajes mine project in Guerrero, Mexico. Torex is on track to pour gold by the end of the year, with commercial production in the second quarter of 2016.

Once in production the mine will be a high-grade (2.69 g/t) operation that is expected to produce 275,000 ounces in 2016. Of note: 104,000 of those ounce are hedged at US$1241 per ounce.

A 2015 feasibility study done at US$1,200 gold shows an after-tax NPV of US$605M (5% discount) and an after-tax IRR of 15.7%.

Third-Quarter Highlights

- Construction was 91% complete at the end of the third quarter of 2015, commissioning is advancing well and construction of the ELG Mine remains on schedule and on budget for first gold late in Q4 2015.

- The resettlement of all 102 families of the village of La Fundición has been completed. Work is continuing on the construction of the second village for the resettlement of the Real de Limón community, expected in the first quarter of 2016.

- There are 1.2 million tonnes of ore stockpiled as of September 30, 2015. Mining of the Guajes and North Nose pits continued ahead of schedule with approximately 605,000 tonnes of Guajes ore and 630,000 tonnes of North Nose ore stockpiled at September 30, 2015.

- Water and grid power were available at the processing plant at the end of the third quarter of 2015.

- Achieving full production of 14,000 tonnes per day requires the second pit, El Limón, to be in production. After the resettlement of La Fundición village, waste stripping and the building of haul roads are now underway for the El Limón pit. Construction of the El Limón crusher and the Rope Conveyor continues, both of which are tracking ahead of schedule. The conveyor on the RopeCon was installed in October 2015.

- The Company has signed a letter of intent with the Ministry of Public Safety of the State Government of Guerrero, endorsed by the Federal Government, for the provision of permanent police presence in the areas adjacent to the Company's Morelos Gold Property.

Fred Stanford, President & CEO of Torex stated: "We are on the doorstep of production and would like to take the time to thank all of the supporters that have helped us along this path of turning intention into reality. Construction on the processing plant is now drawing to a close and attention has shifted to managing the ramp-up process. First gold is expected before year-end and a skilled team is in place and prepared to deal with the inevitable challenges. The achievement of commercial production is anticipated for Q2/16 as per the schedule when construction started. The schedule to achieve full production is tracking well with construction activities ahead of schedule on the El Limon crusher and Rope Conveyor. (The conveyor on the RopeCon has now been installed). We look forward to joining the ranks of the producers in the very near term and once again, the efforts of the many contributors, are much appreciated."

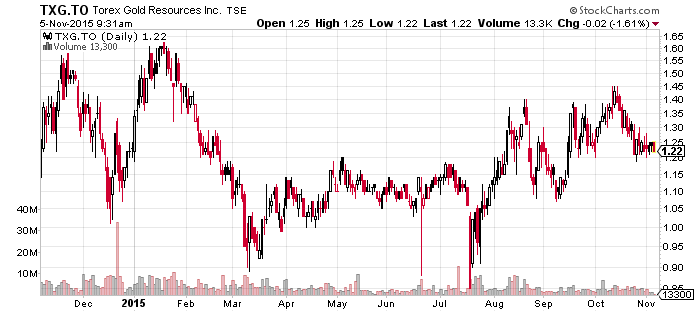

Torex stock can be volatile, with quick moves to the downside or upside as seen in the 2015 chart. The stock is due for a re-rating in the market once the company enters production.

Investors need to watch how the ramp-up period progresses. It appears everything is on track but mine start-ups are typically slow with some hiccups. Mining operations in Guerrero have also had security issues, with cartels active in the area.

Read: Torex Announces Third Quarter 2015 Results

Newmarket Gold - (NMI:TSX) - Third-quarter financials are out from Australian gold producer Newmarket Gold. Cash generated from operating activities was $11.3M but $13.79M was spent in capital investment in the quarter. All-in sustaining cash costs came in at $1011 per ounce.

Newmarket has a couple great slides in its October presentation stating the value gap between the company and other gold producers.

The presentation shows NMI trading at a 2.7X P/CF metric while similar Canadian producers trade at 6x.

The weak Australian dollar is also helping, something investors need to pay attention to when evaluating Newmarket.

Douglas Forster, president and chief executive officer, Newmarket Gold, commented: "We achieved record production of 169,491 ounces in the first nine months of 2015 following another quarter of over 53,000 ounces of gold production, driven by record results from the company's flagship gold mine, Fosterville. Based on production to date, we have reaffirmed the company's top-end full-year production guidance of approximately 220,000 ounces. Total operating cash costs per ounce sold decreased year over year by 20.4 per cent to $715 in third-quarter 2015, resulting in year-to-date operating cash costs of $693 per ounce sold, while all-in sustaining costs decreased 18.0 per cent to $1,011 per ounce sold in third-quarter 2015 and year-to-date all-in sustaining costs were a record-low $984 per ounce sold. We are pleased to see the company's continued focus on productivity and strategic cost-reduction initiatives reflected in the company's results even before the impact of a markedly weaker Australian dollar. Given the company's results to date, we are revising the company's 2015 costs guidance lower and now expect operating cash costs of $700 to $750 per ounce sold (prior $780 to $860) and all-in sustaining costs of $970 to $1,020 per ounce sold (prior $1,020 to $1,100).

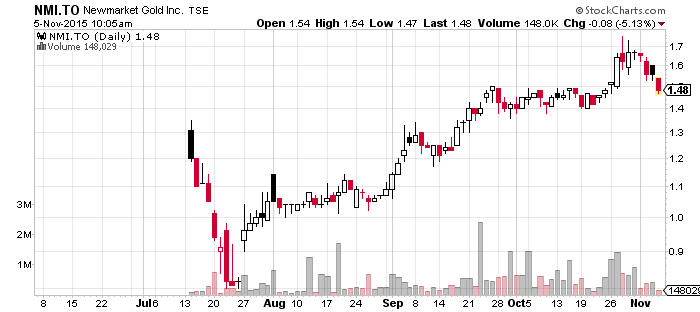

Newmarket Gold's share price has had an excellent few months since acquiring Crocodile Gold in July.

The management team here is some of the best in the business and includes mining heavyweights Douglas Forster, Lukas Lundin, and Randall Oliphant.

Cash balance stood at $37.2 million at the end of September, with a working capital position of $22.6 million.

Join the conversation about your favourite stocks and tap into some sharp insight at CEO Chat daily.

This is not investment advice and all investors should do their own due diligence. Own your trades.