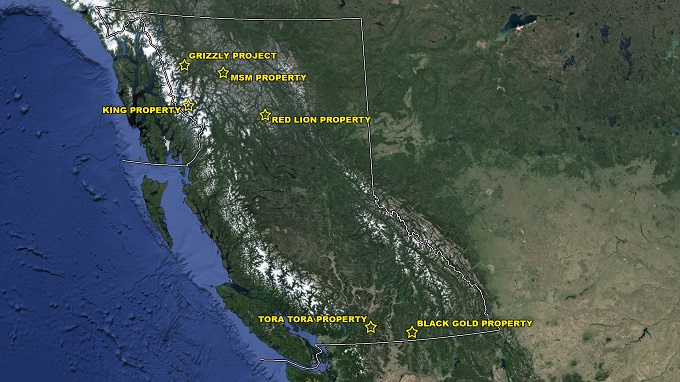

One Venture-listed company trying to make the next discovery is Garibaldi Resources (GGI:TSXV). A company update was provided this morning on the first-ever drilling campaign at the Grizzly property in the Sheslay district of northwestern British Columbia.

Junior mining speculators know the TSX Venture Exchange is desperate for a major discovery that could turn the markets around. Historically, major discoveries have created wealth that has generated excitement among investors (speculators) about the markets and the potential to make 10x-100x your money.

However, the odds of finding an economic deposit are said to be 1 in 3,000. Very few companies are funding drill programs these days as it seems nobody can raise money.

Garibaldi is trying to beat those odds. Three holes have been completed and are being sent off to the assay lab for results.

The target here is the type of copper-gold porphyry B.C. is well known for, one that is big enough to be economic.

Garibaldi will be hoping to hit better intersections than neighbours Prosper Gold (PGX:TSXV) and Doubleview Capital (DBV:TSXV) if they want to see a share price lift.

A reminder on some of the holes in the region.

Prosper

- SO49 -324m of .44% Cu and 0.219 g/t Au (CuEq .57%)

- SO24 - 312.6m of .37% Cu and o.24 g/t Au

- SO26 - 263m of .35% Cuand 0.15 g/t Au

Doubleview Capital

- H-23 - 0.73 per cent copper equivalent (0.36 gram per tonne gold and 0.47 per cent copper) in a 110.9-metre section

Steve Regoci, Garibaldi President and CEO commented, "Visual evidence from the first three holes firmly indicates the powerful influence exerted by the Kaketsa pluton 2 km west of Grizzly Central drill targets. Geological processes appear to have involved a tremendous amount of heat and fluids. It's exciting to see what Mother Nature has cooked up in these rocks over the millennia. The geology speaks volumes for the potential to add to the unfolding story of the Sheslay district where two porphyry deposits have already been defined including Doubleview Capital's gold-rich Hat discovery 10 km east of our current drilling.

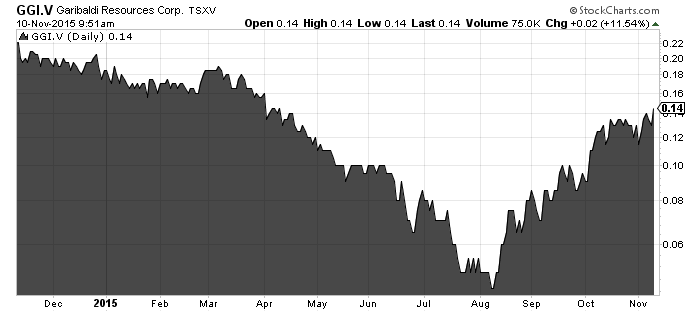

Garibaldi stock suffered in July/August as Sprott blew out a large position that was part of a $1.25-million flow-through financing.

The stock has recovered up to the 14-cent level on excitement of the ongoing drill program at the Grizzly project.

Personally I have no position and am waiting for assays to come back.

At the end of July, Garibaldi had just over $1 million in the till. I would assume that most of that will be gone by years' end and $GGI will be looking to finance again.

If you want to know more about Garibaldi the guys over at BullMarketRun seem to cover the stock every few days. Of course they are biased and disclose they own the stock. Not sure if Garibaldi pays them for the coverage as well as they have yet to disclose that?

Read: Garibaldi Grizzly Central Drilling Update

Join the conversation about your favourite stocks and tap into some sharp insight at CEO Chat daily.

This is not investment advice and all investors should do their own due diligence. Own your trades.