Tintina Resources (TAU-V)

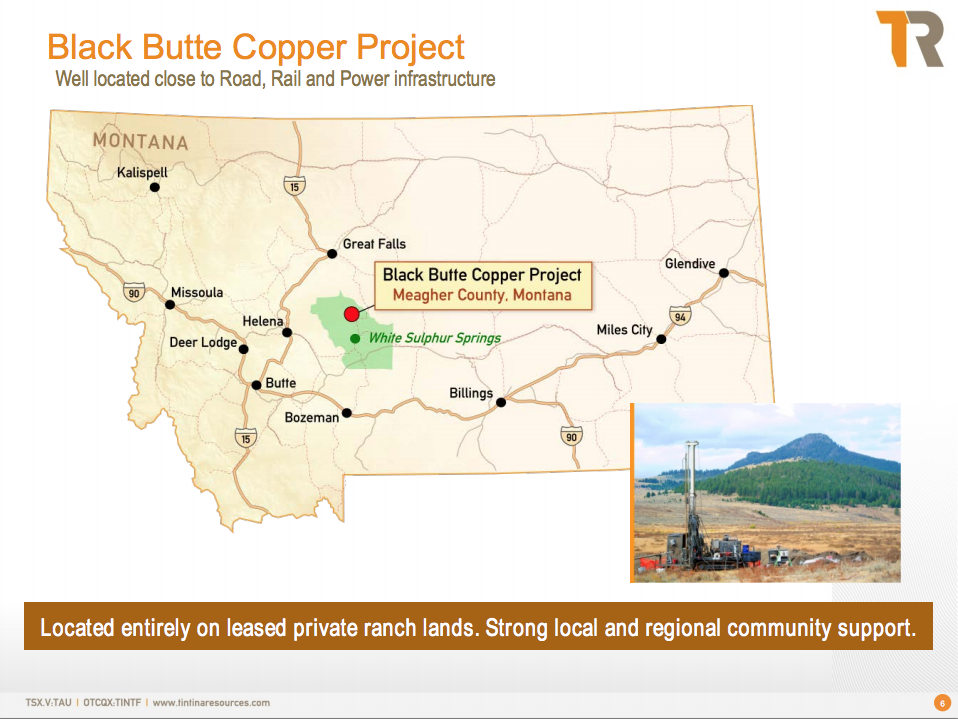

Australian miner Sandfire Resources is buying out George Soros's Quantum Partners to consolidate control of Tintina Resources' Black Butte Copper project in Montana.

The deal will see Sandfire purchase an additional 47,244,095 shares at a price of $.0831 per share, a 38.5% premium to Tintina's Tuesday closing price.

Sandfire now owns 57.19% of Tintina's outstanding shares, and 68.51% including warrants. The Australian miner operates the high-grade DeGrussa copper mine, which it discovered and brought into production in three years.

Black Butte Copper contains 15.7 Mt @ 3.4% Cu (533,600 tonnes) Measured & Indicated, 2.3 Mt @ 2.8% Cu (63,500t) Inferred, according to a July 12, 2013 PEA. That’s about 1.3 billion pounds of copper at grades far above industry averages.

On Nov. 5 Tintina outlines its tailings management plan for the Johnny Lee copper deposit, which includes cementing tailings for underground storage as well as a double-lined surface tailings facility.

Tintina CEO Bruce Hooper, who spoke at CEO.CA's Oct. 8 Subscriber Investment Summit in Vancouver, moved from Australia to Helena, Montana to be closer to the project. He is also Sandfire's Chief Business Development Officer.

NR: Sandfire Resources to acquire additional common shares of Tintina Resources Inc.

Related: Deep-value copper call option in Montana's rolling hills

Northern gold: Independence Gold (IGO-V) and TerraX (TXR-V)

This morning saw news out from gold exploration plays in Yukon and the Northwest Territories.

Randy Turner's Independence Gold intercepted 15 g/t Au over 3.05 metres in the latest results at its Sunrise Zone on the Boulevard project 135 km south of Dawson City. Boulevard is adjacent to Kaminak Gold's Coffee deposit.

Independence completed 1,093 metres (8 holes) of RC drilling to follow up on the summer discovery hole (7.23 g/t over 12.2 m). Other significant intercepts included 22.86 metres of 0.94 g/t Au and 6.09 m of 0.63 g/t.

The latest results "imply that two separate, chemically distinct episodes of high grade gold mineralization have occurred at the Sunrise Zone," according to the company. Further drilling will be required to define the mineralization.

Independence Gold, a spinoff from Turner's Silver Quest Resources (acquired by New Gold), is currently trading for below cash value.

NR: Independence Gold intercepts 15 g/t gold across 3.05 metres at the Sunrise Zone, Yukon

TerraX Minerals also reported assays from an initial six-hole drill program of 953 metres testing near-surface mineralization at the Hebert-Brent shear area at its gold project just north of Yellowknife.

Highlights included:

- 10.36 m @ 3.61 g/t Au, including 2.95 m @ 5.01 g/t Au and 2.58 m @ 6.45 g/t Au in hole TNB15-024

- 6.7 m @ 2.7 g/t Au, including 2 m @ 8.77 g/t Au in hole TNB15-025.

TerraX's projects are located immediately north of Yellowknife on the shear system that hosted the past-produciong high-grade Con and Giant gold mines.

TerraX raised $6 million in June and is 17% owned by Osisko Gold Royalties, Sean Roosen's Quebec-based royalty company.

NR: TerraX drills 10.26 m @ 3.61 g/t Au at Hebert-Brent Shear area, Yellowknife City Gold Project

Join the conversation daily at CEO Chat, the investment conference in your pocket.

Tintina Resources and Independence Gold presented at the Subscriber Investment Summit and Tintina is a CEO.CA sponsor, which makes us biased. This should not be considered investment advice and all investors need to do their own due diligence and conduct their own independent research.