Rick Rule rules the junior resource world with his checkbook. The acclaimed speculator has been financing mining and energy companies for nearly forty years and has the big scores and scars to prove it. From his perch as chairman of Sprott USA, the world’s best known natural resources & precious metals focused investment firm, Rule possesses exceptional insights into the global natural resources space. We were able to connect with Rick for an hour on Friday to get his perspective on gold, the macroeconomic backdrop, the TSX-Venture Exchange, Sprott Inc., and success in natural resources. In his words, “This is a long rant, but you asked for it.”

Navigating the gold market

Sprott and Rule are very public proponents of precious metals ownership. In light of gold’s recent near-$300 crash, it was the natural place to begin our conversation. “If my memory serves me correct, we’re in the 8th or 9th cyclical decline in what I think’s a secular bull market. This correction is perfectly normal and healthy. It may or may not be pleasant -- but how you look at it is your problem.”

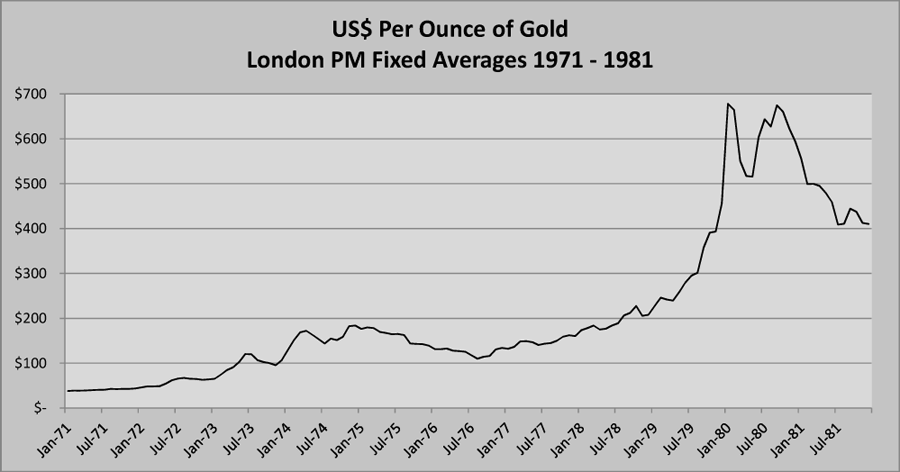

To illustrate his point, Rule brings up the ‘70s-era epic bull market in gold, when the metal ran from $35 to $850. “Many people don’t remember that in the middle of that run there was a cyclical decline in ten harrowing months from $200 an ounce to $100 an ounce,” he said. “Sadly, even gold-owning investors who actually knew what they were doing let their fear get the better of them. So they missed its $100 to $850 move.”

Gold actually hit $850 intraday, but these are the London Fixed prices, which are recorded just once per day.

Gold vs the US dollar

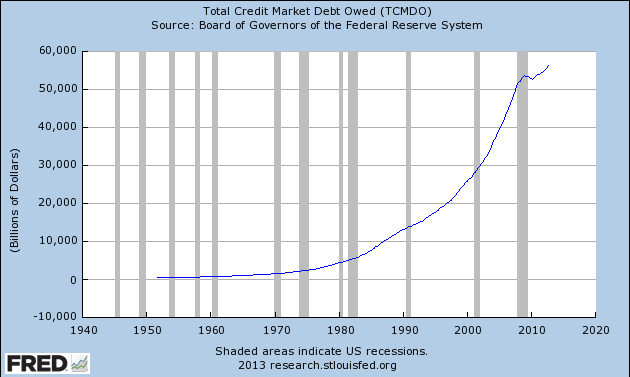

“In the US, we have almost $17 trillion in on-balance sheet liabilities, and almost $70 trillion in off-balance sheet, unfunded liabilities, like social security and medicare,” Rick told me. “We’re running deficits of $1.5 trillion each year -- we’re borrowing half of that and printing the other half. Combine that with off-balance sheet liabilities, which are growing at almost $4 trillion per year, just at the federal level, and you can see where the problems are coming from. Trillion is a big number.”

“Take a look at the experience we just had in Cyprus, where it looks like deposits are going to be tapped,” he explains. “90 years ago, to think depositors wouldn’t be tapped would be silly. What’s happened is we’ve added deposit insurance to a great list of social promises, like old age security and health care benefits, despite the fact that we may be alcoholics or morbidly obese. There have been a whole range of social promises that are in excess of our ability to honor. The great question of the next 20 years will be how we discharge these liabilities. Will we be honest about it and default -- which is very deflationary -- or will we be dishonest and inflate away the liability over time? If it’s door #2, as I expect it will be, it’ll be extremely beneficial for the price of bullion.”

On investor psychology

“The average human mind forms its perception about events that are likely to occur in the future in the context of very, very recent experience. The fact that the US bond and stock markets have been relatively good reinforces the perception that they’ll continue to be so,” Rick continued.

“People tend to search for information that reinforces (and doesn’t challenge) their existing preconceptions. They don’t want to confront frightening realities. They would rather immerse themselves in pleasurable circumstances that they believe are true,” he told me. “So it makes perfect sense that the media and government have convinced the investing public to believe that liquidity and easing is a substitute for social solvency. We’ve lived beyond our means and we’re leaving the bill with people your age. Wonderful work if we can get it, but I don’t know how long it will last.”

Advice for investment advisors

“A plan that I’d articulate to clients would include some number, depending on the client’s wealth and liquidity, of up to 10% in bullion and bullion-related products,” Rick said. “Despite the fact that your purchasing power on cash is beginning to erode, accounts need to be very liquid, because I don't see that the possibility of a psychotic break like 2008 has been eliminated. If we do get another psychotic break, having the cash might not give you the courage, but it will provide the tool to take advantage of irrational activities by others. I think that the bulwarks of portfolios now are bullion and cash.”

“Moving up from there, we’re encouraging clients to participate in natural resource equities -- particularly smaller resource ones. The narrative hasn’t changed since 2006. All the factors that were in place for a secular bull market in resources are intact. The very best assets in the junior natural resource sector are on sale for up to 70% off. Investors have to understand that the down cycle can go on for 4-5 years, but in my experience, being early is enormously preferable to being late.”

He continued, “We spent about 5 million dollars yesterday. I’m pretty certain I’m early. We’re in the early phase of capitulation selling -- the last phase of a bear market. Soon we’ll go into the summer doldrums, and the junior market -- the TSX-Venture -- will I think truly bifurcate this fall. I think the best 5-10% of issuers have flattened and will go up beginning this fall. I think there will be a cleansing in the rest of the market though, that could last 18 months, where the real penny dreadfuls will flirt with their intrinsic value, which is zero. So it’ll feel like we’re in a bear market for another two years. But the money that can be made when goods are on sale in volatile markets is extraordinary if one doesn’t buy the sector, but buys individual issues which are irrationally priced down. With regards to the TSX Venture index, if you ever buy it from your broker, you will get broker and broker and broker.”

“This is the first time since 1992 that I’ve seen high-quality gold development assets reasonably and cheaply available in the market, and by ‘cheaply,’ I mean after tax IRRs above 25% and hopefully above 30% using current prices,’ he said. “We aren’t seeing large companies acquire smaller ones because the seniors are busy digesting the mistakes they’ve made over the last 10 years. They will definitely need to begin acquiring. Because in the mining sector, where your business is in constant liquidation, if you're not exploring, which they’re not, or acquiring, you are six or seven years from extinction.”

Which stocks should we be following?

“I can’t provide recommendations. I can only disclose to you what Sprott is buying. Right now, we are sporadically buying Lydian International (TSX:LYD) and Belo Sun Mining (TSX:BSX), although we’re holding off on Belo Sun now until they get their permits. I’m personally buying Ivanplats (TSX:IVP) -- Ivanplats has three mind-boggling deposits run by the most successful mining entrepreneur of my lifetime, selling at remarkable bargain prices.”

“In British Columbia, I think a sweep by the NDP is likely, and the market will sell down BC oriented mining companies, much to my advantage, because Pretium Resources (TSX:PVG) outreach efforts to first nations has been incredible. I believe they’ll be protected, which is one of the reasons why I’ll be an aggressive buyer of Pretium in the selloff of the aftermath of the BC Election.”

He went on: “Reservoir Minerals (TSX:RMC) confirmation drill holes were as good as I’ve seen in 30 years of the business, and the stock traded off a buck. I think that’s spectacular, I love it when that happens. Another example would be Bear Creek Mining (TSXV:BCM), where they crossed an enormous threshold with their community social license agreement. This has been very difficult to do in Peru. It’s taken them two and a half years, and they’ve done a superlative job. When they announced they had the total backing of the community, they already had the federal backing, and the stock traded down by 8%. This is a wonderful set of circumstances for a risk manager, because I can buy these companies, having gotten the crucial information, for prices between 10-30% less than the companies were selling for before I got the crucial information. I bought shares in both of these companies.”

On selling his firm to Sprott Inc.

When I asked Rick why he sold his California-based Global Resource Investments to Sprott Inc. in 2010, he told me he was spending too much time on the business rather than managing money, which he felt was “dishonest.” He enjoyed the money management side much more than business administration, which he relayed to his friends Eric Sprott and Peter Grosskopf, who ran Eric’s business.

“They told me they’d be happy to run my business for me,” Rule said. “When I sold I did not sell for cash, I sold for shares. If you look at Sprott Inc. (TSX:SII), it’s true that the share price performance has been terrible, but I think some of the improvements in Sprott in the last couple of years -- the development of the physicals platform where we now manage $4.5 billion of exchange-traded product, the recently announced joint venture with Zijin mining and some other JVs (to follow with very large influential investors on a global basis) -- will substantially benefit Sprott’s shareholders.”

He continued, “The only thing we do is natural resources, natural resources, and natural resources. We have focus. We also have no liabilities -- a pristine balance sheet with no debt. The market is giving us no value for the Canadian asset management business, and the US business. When the market returns, and it will return, that’s a business that generated $200 million per year in performance fees for a couple of years, and you can have it for free. You also get the US business for free, which is generating large returns for shareholders. If you look at Eric Sprott’s or my own performance in 1998-2002 when we hit bottom and were in that ugly, grinding bear market, we both generated extraordinary rates of return for our investors in those days. We’re still just as competitive, intelligent, and hard-working now as we were then.”

Who deserves more credit in mining?

“Brent Cook does an anomalously good job as newsletter writer,” Rick praised. “The person who doesn’t get anywhere near enough respect in this market, although he demands it (laughs), is Robert Friedland. He has Kamoa, Flat Reef, and Kipushi in one vehicle, and has had it for 18 years. He’s had the persistence, tenacity, and brilliance to build that company through thick and thin. He’s assembled two game changers and three-world class assets in one vehicle. It’s astonishing.”

When I asked Rick what made Friedland such a special promoter, he explained, “20 years ago you’d have what you thought was a casual conversation with Robert, and you’d figure out later that you’d been interrogated. He’d carefully ask you questions and make statements to gauge your reaction, so he could identify what your hot buttons were and tailor his story to your individual needs. He also has a memory unlike any I’ve ever seen.”

He continued, “Adolf Lundin was equally seductive, but that was because he made so much money for me, and I liked him so much. We’d have dinner together, and I’d say, ‘Adolf, lets just get this over with, who do you want me to make the check out to, and for how much? Then we can just have dinner.’” Rule said Lundin was an early mentor to him, as was Chester Miller, who founded Glamis Gold. “I had been lucky enough to associate with those guys in the 1970s, and I did very well with them, but I confused a bull market with brains, and I paid an extravagant price for that ignorance in the early 80s. The good thing that happened to us old guys, and is happening to your generation now, is there were a couple times when our intestines got spilled. Everyone I know who was successful had vicious times, let’s not forget that.”

Thanks for the interview Rick.

Re: unfunded liabilities, like social security and medicare

Here we go again. With $2.7T in its trust fund and solvent for the next 20 years (during which time a lot of water will flow under the bridges), and U.S. Treasury routinely raiding its coffers, Social Security is still persistently labelled by some as “unfunded liability” not to mention that outrageous word “entitlement” as if it is some sort of handout given to the undeserving.

It is also not clear what funds the fat salaries the members of our Congress give themselves, not to mention their automatic pay raises, their generous llifelong pension plans and government-run lifelong socialized medical cares and why nobody ever points a finger at them. Ditto for Obama and his new-found right-wing zeal to balance the budget on the backs of the old, the sick and the poor.

Ulysses, do us all a favor please don’t breed

Hey, if those liabilities are funded, what’s your beef with allowing us young folks to opt out of paying Social Security?

Don’t like it when people call your bluff, eh?

I have been paying for social “security since I was a teen ager (1943). Now, I am getting payback.

Can’t say it’s a good deal. The SCOUS ruled that the 15% the S S administration grabs from all workers and employers is a tax, so I guess I’m lucky to have gotten anything. If the administrators wouldn’t pay me, they’d might have some trouble in collecting that tax from current payors.

In any case, I remain convinced that the USA government gets things wrong most of the time. i did get some time in WWii, where incompetence was on display.

Good interview. He’s amazing.

Hi!, Patrons Of CEO CA Et Al:

If the reader can find it and is interested, there’s a book, Wall Street The Other Las Vegas, by Ncholas Darvis which goes to great lengths to explore that brokers don’t care which stocks you purchase, as long as they, as the sure money men, make their commissions along the way. No broker will EVER backstop any investments anyone makes through them. Once you buy you’re on your own mercilessly. The old addage cavaet emptor or buyer beware comes to mind at this time. It’s always the little guy investor who assumes the major risks isn’t it? First and formost therefore, in my personal opinion, Rule is a broker pawning off risk to his less informed clients just like all the rest of the world’s brokers. Why shouldn’t he, because what they have to sell has worked in their favor sense time immemorial.

RUSS SMITH, CA. (One Of Our Broke Fiat Money States)

resmith@wcisp.com

There isn’t a better way to learn about what’s really happening on the ground at gold mines than listening directly to the CEOs themselves. The junior gold sector has been struggling recently. Brent Cook recently said on BSN that 80% of juniors won’t last the next decade, which I agree with. This is also echoed in the former Franco-Nevada COO’s interview I just read here: http://seekingalpha.com/article/1219881-exclusive-interview-with-pershing-gold-s-stephen-alfers