Last week we were looking for a big move in gold with a good chance that prices would either test 1550 or 1650 once the multi-week ascending triangle resolved. Sure enough gold made a $65 high to low move last week as prices tumbled below the key support at 1550, testing bulls' resolve once again.

The most interesting aspect of Friday's big gold rally is that it occurred very quietly, with hardly any fanfare. Moreover, if you consider that sentiment is extremely depressed and the vast majority of short term marginal market participants are leaning heavily to the short side you have the perfect recipe for a huge rally.

Consider the following collection of charts:

Click to enlarge

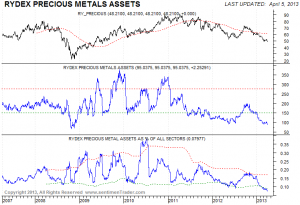

Rydex precious metals assets have hit the lowest levels since early 2009, this has historically proven to be a powerful contrarian indicator:

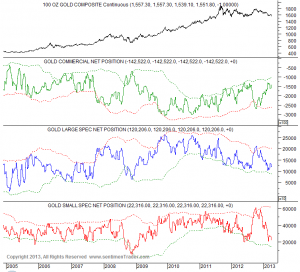

Large & small speculators continue to aggressively liquidate long positions in gold futures:

Gold Weekly:

Gold Daily:

And perhaps the most interesting chart of them all highlights the fact that not only did gold pass yet another test of major support at 1550 last week, but it also held above the key 36-month simple moving average which it has held above since the inception of the current bull run which began in 2001:

There is clearly a great deal of evidence which suggests that gold prices may have tested support in the mid-1500s for the final time in what may eventually be remembered as the quietest bottom in the history of the gold market. Even an equity market focused publication such as Barron's has taken to highlighting the bearish sentiment and positioning in the gold market, going so far as to recommend that readers speculate on short term downside in gold via GLD weekly put options - a curious recommendation to say the least.

Only time will tell whether this will turn out to be a key turning point for gold, however, there are simply too many clues to ignore the potential significance of this moment.

No matter what price they are able to put on gold using naked paper shorts,

I am holding on to my K-rands.

Hi!, Zorba Et Al:

Please watch MELTUP@ The National Inflation Association’s Website (almost an hr.) where towards the end Billionaire International Speculator, Dr. Mark Faber, says gold should be $1,000,000 a troy oz.; while OUR great governments’ price remans @ $421.22/troy oz. Why this major difference? The gold in Fort Knox etc. should be minted for FREE into gold coins and distributed to all Americans Ntionwide @ Dr. Faber’s price and would that allow for the people to start their own independant eonomic recovery without OUR Government nor the FED? Article 1; Section 10 of the US Constitution calls for gold and silver coins only with no opportunities for paper money whatsoever. How have we reniged on OUR Constitutional mandates; in order to maintain the total disorder of fiat paper, I Owe U Nothing, money that consistantly depreciates in buying power constantly raising prices? The elite have finally seperated US from OUR Constitutional money; so that their paper money aristocracy can rule our pocket books and our minds via constantly rising prices. They forced the price of gold into the Futures Market where it has been completely denagrated from its’ true value against their paper money aristocracy based upon gold’s price reactions to geopolitical events and not their monetary misbehavior. France tried to escape this episode; when the government of Frane closed down the gold and silver exchanges and sent to the guillotine anyone asking before a purchase was consumated between buyers and sellers (when caught) if payment would be in either specie gold and silver money or paper, I Owe You Nothing, fiat money. Readers should either pick up a copy of Fiat Money Inflation In France by Andrew Dixon White or find it published on the internet. White was the co-founder of Cornell University. He tells how the inflation came; what it brought to France and how it finally ended.

RUSS SMITH, CA. (One Of Our Broke Fiat Money States)

[email protected]

Right now the daily, weekly and monthly lower Bollinger Bands for $GOLD are at 1558.83, 1543.55 and 1531.80. It is only when they show a steady upward slope with daily < weekly < monthly that we will reach long-term bottom. From that perspective, a bottom at 1500 seems most probable.

With Central Banks net accumulating gold for the last couple years and no signs of them selling, I would say these are attempts at depressing the gold price to drive out small investors so the surplus can be sopped by big players for the impending massive rally in gold. I find their tactics of driving the herd mentality despicable. Any investor that doesn’t recognize that is destined to be a victim.

Stay Long you can’t go wrong