This morning gold has broken key support near $1240 and hopes for a head and shoulders pattern bottom are all but dashed:

Click to enlarge

The white oval is the 'last stand' area of support I highlighted earlier in the week - gold is currently at a level of 'oversold' (green ovals) that has historically coincided with price bottoms. Will this time be different?

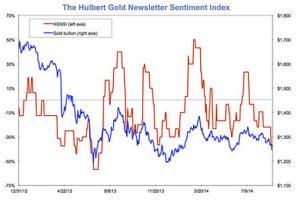

Technically speaking the situation is quite dire for gold; there isn't a clear area of support for another $50 lower ($1180). However, according to Mark Hulbert we are now at the lowest sentiment levels since the June 2013 bottom:

And bloggers are jumping all over the downtrodden gold/silver bugs with posts with titles such as "Silver bulls may eventually be right, but they are still idiots" or "The Downside Target in Silver is Below $15" which include quotes such as "One of the scariest looking charts in the world today has to be Silver. The other popular precious metal, Gold, is looking pretty terrible itself" or "Silver could drop all the way back to $6 to $8 and remain in a long-term bull trend". While some of these types of posts make valid points on both technical and fundamental levels, writing about silver falling to $6 is alarmist by any interpretation. These posts also help to highlight the extreme bearish sentiment that is pervasive after such a grueling decline in precious metals.

The fact remains that human beings have an overwhelming tendency to become alarmist and panic near price bottoms. A couple of the most respected gold market observers are also striking a relatively cautionary tone right now.

"Gold will remain under pressure as long as the markets continue to believe that the world, specifically the US, is in full economic recovery and higher interest rates are just around the corner. Personally, I am very suspect. Add to that, the recent "calm" on the geopolitical front (Russia, Ukraine, Iraq, IS, Israel, Hamas) and you have all the reasons to sell gold you need. I'm not sure all of those issues are behind us either. And as long as the US stock markets remain in bubble territory, they will ostensibly continue to provide an alternative to gold."

While I know Giustra is a long term gold bull his comments leave me on the fence about buying gold given some of the short term issues he pointed out. Perhaps an investor will get a cheaper price in two weeks?......And here is Frank Holmes of US Global Investors:

"Gold in Euro terms is looking fantastic. The US economy is carrying the world now and this makes the dollar on a relative basis look better. It's like a beauty contest for the fat people, who has the most fat debt wins... The real issues for the fear trade are negative real interest rates and Europe is in the worst shape to battle deflation. The US is also selling 5 year bonds at negative real interest rates. The G20 are tax collectors and manipulators of interest rates to manage currencies. The other part of gold demand is the love trade, this relates to rising GDP per capita. China has stalled and now India has begun to grow under new leadership."

Not exactly motivating me to go out and buy bullion either!

While I must respect the technical situation in the gold/silver charts and I cannot say that it is prudent to buy precious metals today. I can emphatically state that with sentiment at such depressed levels it is NOT time for investors to sell gold and silver.

for some reason, Frank Giustra reminds me of Patsy Cline, women’s underwear and bottoms.

Hi!, Patrons Of CEO CA Et Al:

These types of posts help me redefine the difference between speculation and investing: A speculation always carries unknown and unresolvable risks; while an investment is a “GUARANTEED” return on your money. So, under that kind of observation, I continue buying silver up or down in price so when all the risks are worked away then the guaranteed return on my investing in silver will take the helm. I am operating in the realm of speculative risks but I know that sooner or later a real return on my silver purchases will exist. Perhaps silver can collapse clear down to its’ historic low of around $3.50 but who cares? By that time how many silver mines will be closed; how many shorts will have to be covered plus how many silver speculators on the long side will have thrown in the towel? Who cares?

MY FOCUS

My focus is on the fact that silver is being used almost daily in additional industrial production capacities in larger quantities. It is being drawn into a very thin wire form, to be used in all electronic productions worldwide and that wire per 999.99 troy oz. of industrial silver achieved by electrolysis can be 50 miles. It can be used to produce silver haloids for colored film production we use in our family albums up to 5,000 pictures per troy oz. The list is almost endless and growing. This past week a broker pointed out to me that the time may be in the not too distant future when silver may not be available at any price due to shortages. If that time becomes a fact in the market for silver, I want to have mine, in order to benefit from the obvious price explosion such an event could cause. In my opinion the time definitively arrives when it doesn’t pay to nickel and dime these markets and be left behind when their trains leave their stations perhaps forever!! All of modernized industrial productions depend upon silver and that is not going to go away ever, as long as civilization survives is it? The rest of you can speculate all you want; while I just keep on buying. If the price goes lower, I’ll be just like the Chinese and buy additional silver at lower prices because that’s where the price is trading at that moment. So, basically, I look forward to both higher and lower prices for silver as its’ future demand and supply configurations unfold daily.

RUSS SMITH, CA. (One Of Our Broke, Fiat Money States)

resmith1842@gmail.com

Does CA refer to California or Canada? Either one would fit, eh?

Forgot one factor: RISK. All these paper asset classes are undeniably risky while gold, at these below-extraction-cost prices, is most definitely NOT. With everyone still in this craven, desperate, grubby, short-termist dash for yield at any cost, heedless of risk, the wheels almost have to come off… Gold is for investors, not speculators.