Unsurprisingly one of the few groups in the out-of-favour resource sector spending significant money to build new mines and finance risky ventures are the Lundin's.

Yesterday, Lundin Mining (LUN:TSX), the $3.2 billion mining company that its namesake founder Lukas Lundin owns 12.5% of, announced that it started concentrate production ahead of schedule and on budget at the recently acquired Eagle nickel-copper mine in Michigan. Mill commissioning was compelted last week and they have run it at full capacity without issue (typically a challenging time filled with setbacks).

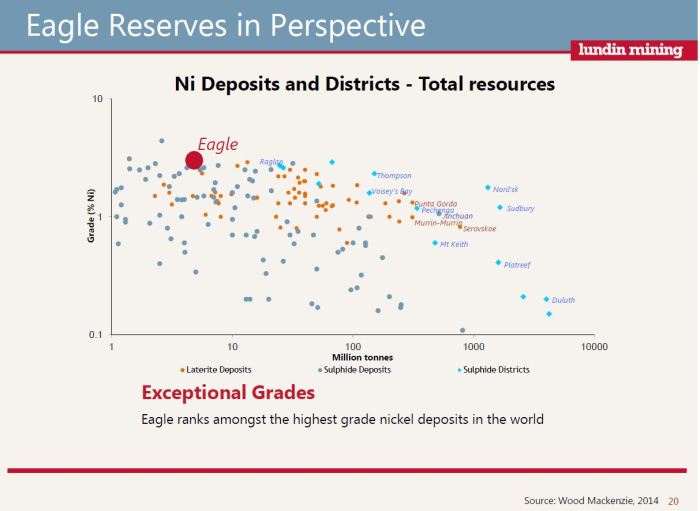

The Eagle mine represents one of very few new nickel mines around the world. It also happens to be one of the highest grade ones as well. The company expects to ship first saleable copper and nickel concentrates during the first half of October and is expected to reach full design rates in Q2/2015.

Mr. Paul Conibear, President and CEO commented, "We are extremely proud of the tremendous achievement that has been accomplished at the Eagle Mine. The Eagle Mine is a significant new, high-quality, low-cost mine, that has been constructed to the highest of safety, environmental and social responsibility standards."

The company is guiding 23,000 tonnes of nickel and 20,000 tonnes of copper concentrate annually during the first 3 years of production (2015-2017). Importantly, the mine is expected to generate significant margin and free cash flow. Cash costs of approximately $2 per pound provide significant capacity for cash flow generation. With nickel currently trading at $7.80 per pound, the Eagle mine could generate nearly $300 million of operating profit next year from their nickel production alone (not including any of their copper production).

With the rumours that Lundin is in advance talks to acquire the Fruta del Norte project in Ecuador, we've heard that Lukas Lundin is in Europe gauging investor appetite for this acquisition which could be between $250 million and $1 billion.

In October 2007, the year before Fruta del Norte was taken over by Kinross, the deposit had at least 13.7 million ounces at 7.23 g/t gold with plenty of upside. Kinross acquired the project by buying Aurelian Resources in 2008 for $1.2 billion but subsequently recorded a $720 million write down last year after the company was unsuccessful at negotiating economic terms with the Ecuadorian President.

By all accounts the Lundin's are the best in the business, but raising that kind of money in this market (even for a group like that) is no easy feat. If they can't find the money, the rest of us might as well go on vacation for a couple of years because we haven't got a chance. If anyone can do it, its them.