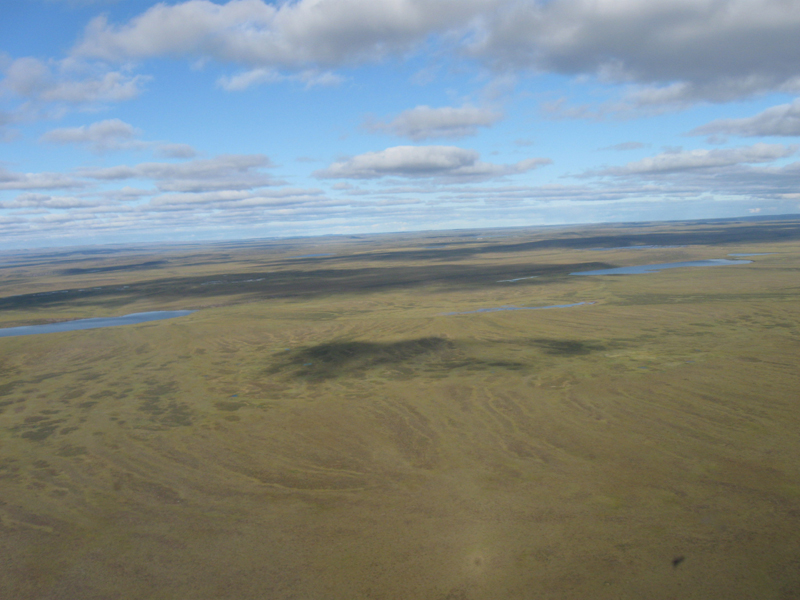

Tundra Copper's claims cover just 310 square kilometres, but Kaizen has staked an additional 3,320 square kilometres in the area (Photo: Tundra Copper)

Matthew Hornor's Kaizen Discovery (KZD.TSXV) announced its latest acquisition this morning: Tundra Copper, a private copper explorer with assets in Canada's tundra. Kaizen made an all stock offer to acquire Tundra and their Coppermine River project, valuing the early-stage explorer at approximately $2.5 million.

In the release, Kaizen also announced that they staked 3,320 square kilometres of land and applied for prospecting permits near the Coppermine River project in Nunavut. This staked land, combined with the 310 square kilometres being acquired from Tundra brings Kaizen's total exposure in the district to 4,240 square kilometres.

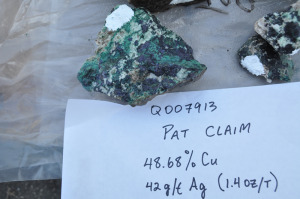

The Coppermine River district is best known for the 'Coppermine River Group' basalts that feature extremely high-grade copper that occur within the volcanic pile. Tundra says their claims are full of these basalts and include over 18 prospective mineral showings, most of which are structurally controlled along steeply-dipping fault fissures and fault-breccia zones in the basalts.

B. Matthew Hornor, President and CEO of Kaizen, said "the combination of the ground that Tundra Copper holds, along with the ground recently staked by Kaizen, offers a district-scale opportunity for discovery."

According to the Tundra Copper website, explorationists at the company took 13 surface samples at the project earlier this year to confirm historic data. They assayed up to 48.68% copper in these samples.

Historic work delineated widespread copper and silver mineralization and drilled up to 70% copper and 8 ounces per tonne of silver.

There are a number of high-grade base metals and gold deposits in the region, including:

- MMG’s High Lake deposit which contains 17.2 million metric tonnes (Mt) grading 3.4% zinc and 2.3% copper

- MMG's Izok Lake deposit which contains 14.8 Mt of 12.8% zinc, 2.5% copper

- TMAC Resources (private) reported a resource of 6,674,500 tonnes grading 11.4 g/t gold in a recently completed PEA on its’ Hope Bay project.

"The opening of Canada's north through accessible seaborne shipping lanes, infrastructure development initiatives, availability of locally sourced equipment, supplies and skilled personnel, and regional support for the development of natural resources are expected to benefit Kaizen's plan to aggressively explore this unique project," Mr. Hornor added.

Kaizen continues to acquire 'down-and-out' exploration companies. In April 2014, they acquired West Cirque Resources and their portfolio of base metals exploration projects in BC.

Kaizen has big Japanese money behind it. ITOCHU Corp is one of Japan's largest metals traders and in February of this year they signed a framework agreement with Kaizen which essentially stated that they will financially support Kaizen's exploration expertise at the project level (minimal dilution to common shareholders).

With that financial backing Mr. Hornor and his geological team, which is almost entirely made up of seasoned PhDs, have been searching for acquisitions (both corporate and asset level) that could eventually provide ITOCHU with much needed metals for Japanese industry.

In this way, Kaizen is a publically-listed private equity vehicle with an extremely long mandate.

"This is another significant step in the strategy of positioning Kaizen for future growth. Kaizen's long-term growth strategy is to work with Japanese entities, including its strategic financing partner ITOCHU Corporation, to identify, explore and develop high-quality mineral projects that have the potential to produce and deliver minerals to Japan's industrial sector," Mr. Hornor said.

According to Kaizen, Kaizen still looking to acquire more. They like well-known copper districts across South America such as Chile and Peru.

The company has cash to support its exploration efforts which now span Australia, Africa, BC and Nunavut. As of June 30th they had over $11.2 million in cash.

Kaizen shares are thinly traded, but the market cap is approximately $55 million.

Very good — a private co. — this is brilliant! tc