Silver Wheaton (SLW:TSX) the world's largest precious metals streaming company with a market cap of ~$10 billion is out with Q4 and annual results yesterday evening. I am a big fan of the streaming business and believe it should be a part of every resource investors portfolio.

I just got off the live conference call this morning to get the latest. Here are my notes.

- Silver equivalent production actually decreased slightly year over year from 35.8 million ounces to 35.2 million ounces.

- Net earnings of $262 million (75 cents per share) down from $375.5 million in 2013.

- One of Silver Wheaton's largest royalty deals with HudBay's Constancia project has just started production with commercial production expected in Q2.

- On March 2nd, Silver Wheaton acquired an additional 25% of Vale's gold production from the Saloba mine in Brazil for $900 million. Silver Wheaton has now doubled its streaming agreement on this mine to 50% with the first agreement made in 2013. The current mine life is 40 years and has significant exploration potential.

- Silver Wheaton has delivered 900% growth in silver equivalent ounces backing each share in the last 10 years.

- Cash operating margins over 70% in 2014.

- Approximately $3.2 million in charitable contributions was made in 2014.

Organic Growth

- For 2015, Silver Wheaton's estimated attributable silver equivalent production is forecast to be 43.5 million silver equivalent ounces (1), including 230,000 ounces of gold. This represents an increase of over 20 per cent from 2014.

- For 2019, estimated annual attributable production is anticipated to increase over 40 per cent compared to 2014 levels, growing to approximately 51 million silver equivalent ounces (1), including 325,000 ounces of gold.

- All of this growth is fully funded allowing SLW to invest it's strong free cash flow to make further investments.

- The focus remains on finding high quality assets with costs in the lowest quartile. The goal is to find "healthy and happy" partners as if the partners are happy and profitable so is Silver Wheaton.

Randy Smallwood, CEO, Silver Wheaton: "While the precious metal markets remain quite volatile, Silver Wheaton's business model was designed to perform well throughout the commodity price cycle. When precious metal prices climb, we tend to generate substantial cash flow. Conversely, in challenging price environments such as these, we tend to focus on acquiring accretive new precious metal streams to enhance our organic growth profile. A good example of this is our recent acquisition of additional gold from the Salobo mine."

If you want to bet on silver SLW stock is most likely your safest vehicle to do that. A big couple years of growth is coming with 20% this year and 40% by 2019. If the silver price increases you can really get some torque in the stock and you get paid a small dividend to wait.

I also favour the acquisition of the additional 25% stream on the Saloba mine as it begins generating revenue immediately. No waiting for a mine to be built and go through ramp up.

I have SLW on my watch list. How about you?

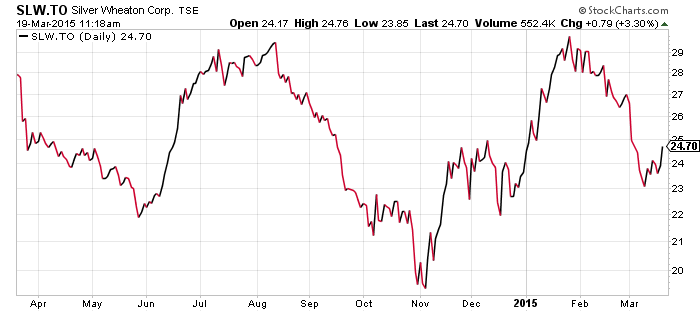

Symbol: SLW.T

Share price: $24.92

Shares outstanding: 403.17 M

Market cap: $10 B

Read: Silver Wheaton reports fourth quarter and full year results for 2014

Related: A silver company safe enough for my Grandma to invest in

Discuss in CEO.ca live

This is not investment advice. All facts are to be checked and verified by reader. As always please do your own due diligence.