A look this morning at financial results from two of the producing mining companies with operations in British Columbia, Canada.

Thompson Creek Metals - (TCM:TSX) - Thompson Creek Metals is out with third-quarter financials at its Mt. Milligan mine in British Columbia, which has now been in operation for 2 years. The mine has large reserves with 2.4 billion pounds of copper and 6.2 million ounces of gold for a 24-year mine life.

Payable production at Mt. Milligan mine for the third quarter of 2015 was 16.4 million pounds of copper and 53,791 ounces of gold. The mine is still working to reach full throughput of 60,000 tonnes per day, which is expected at the end of 2015.

Thompson Creek lost money in the quarter with a net loss of $60.9 million which included primarily unrealized non-cash foreign exchange losses of $68.8 million.

Jacques Perron, President and Chief Executive Officer of Thompson Creek stated: "We continue to focus on operational improvements at Mount Milligan Mine and our efforts have been rewarded by our excellent unit cash cost performance year-to-date. We are pleased to report that we successfully completed the installation of the second SAG discharge screen deck on October 26, and that the commissioning of the new configuration was completed at the end of October, with both screen decks operating as expected. Since restarting operations following the mill shutdown, we have been experiencing gradual improvements in throughput. Other than the permanent secondary crushing plant, all major modifications required to achieve our objectives have now been successfully completed, and we are confident that throughput will continue to increase through the remainder of the year."

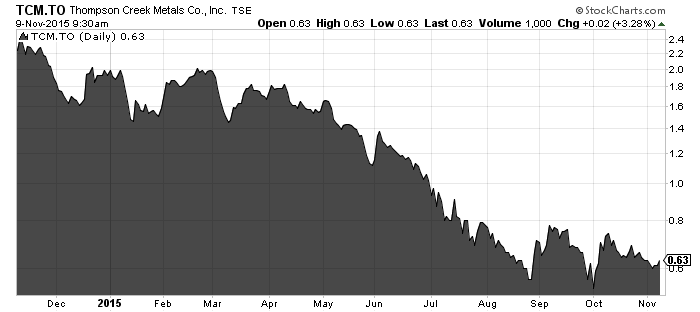

Thompson Creek stock has been smashed over the past 12 months on a lower copper price and concerns over debt. At the end of the third quarter, cash balance was $217 million with debt of $891.5 million.

Thompson Creek announced that it has engaged Moelis & Company and BMO Capital Markets to assist the Board in evaluating strategic and financial alternatives available to the Company, including debt refinancing and restructuring, new capital transactions and asset sales.

TCM will be hosting a conference call at 9 am PST which I plan to be on. I will update this post with further insights if warranted.

Copper Mountain - (CUM:TSX) - Copper Mountain is also out with third-quarter financials. Copper Mountain achieved record throughput in the quarter of 37,400 tonnes per day. The Copper Mountain mine is owned 75% by Copper Mountain and 25% by Mitsubishi Materials Corporation.

Highlights (100-per-cent basis):

- Copper, gold and silver production for the third quarter of 2015 at Copper Mountain mine was 20.4 million pounds of copper, 6,300 ounces of gold and 64,900 ounces of silver.

- Revenues for the third quarter of 2015 were $63.7-million from the sale of 21.9 million pounds of copper, 7,800 ounces of gold and 65,300 ounces of silver.

- Adjusted earnings before interest, taxes, depreciation and amortization were $14.7-million for the quarter.

- Adjusted earnings were $2.0-million for the quarter.

- Cash on hand at the end of the quarter was $18.5 million.

Jim O'Rourke, president and chief executive officer of Copper Mountain, remarked: "We are very pleased to see another consecutive quarter of mill throughput improvements that have been made possible by the addition of secondary crushing. During the quarter the mill achieved a record quarterly average throughput of 37,400 tonnes per day, 7 per cent above our design capacity of 35,000 tonnes per day. The 39,100-tonne-per-day average mill throughput achieved in July provides management encouragement for further improvements. We continue to focus on maximizing production while minimizing all costs. Recent modifications have provided further gains, and we are confident these gains are sustainable."

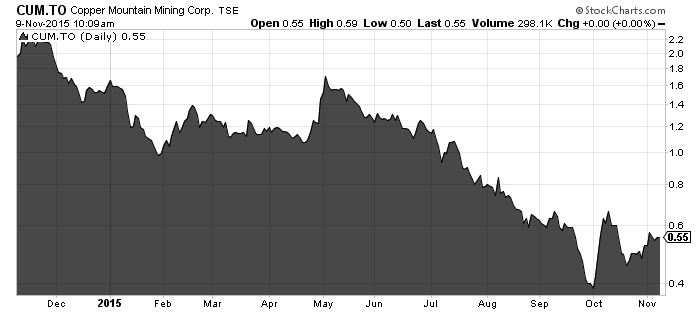

Copper Mountain stock has also been crushed on lower copper prices and debt concerns. The balance sheet here is ugly, with only $18.4 million in cash as of Sept. 30.

Current liabilities are $62.5 million with long-term debt of $371.1 million.

The repayment schedule goes through 2023 and is back-end weighted ($230 million is due after 2017), but investors here need to hope for higher copper prices and soon.

Read: Copper Mountain loses $28.12-million in Q3

Join the conversation about your favourite stocks and tap into some sharp insight at CEO Chat daily.

This is not investment advice and all investors should do their own due diligence. Own your trades.